By Carly Midgley

Photo courtesy CJA

It is rare for an issue to have enough galvanizing power to spark the formation of an organization that continues for 100 years, but the jewellery excise tax (JET) did precisely that. Beginning at five per cent and ultimately rising to 10 per cent before being repealed in 2006, the tax inspired the establishment of the Canadian Jewellers Association (CJA), presenting it a challenge that took 88 years to overcome.

The still-lingering result of fundraising efforts implemented during the First World War, the tax put significant financial strain on Canada’s largely family-owned jewellery businesses. While several ‘luxury taxes’ were introduced at the same time as the JET, most other affected industries were exempted by the time CJA was formed in 1918. However, some of these other taxes were still in place, a fact cited by the government in 1947 as the reason the jewellery tax could not exclusively be eliminated.

An article written by Jonathan Birks and Pierre Akkelian (consecutive chairs of CJA’s Government Relations Committee) in the July 2013 issue of Jewellery Business notes some of the problems the group faced during this lengthy battle, including an “atmosphere of overt doubt as to our ultimate success, both among our peers and those outside the jewellery industry.” Adding to the complexity of the issue was the fact few Canadians were even aware of the excise tax’s existence, which made it difficult to rally public support behind the cause.

Birks and Akkelian worked to combat the excise tax over the course of 13 years, garnering the support of government relations firms and meeting with various government officials to present arguments against it. Their primary points included the following:

- the tax reduced the competitiveness of many Canadian jewellery products, forcing Canadians to look to foreign markets to procure items such as diamonds;

- the tax did not provide much government revenue and thus was lacking any legitimate rationale; and

- the perception of jewellers as wealthy enough to accommodate the tax was inaccurate, as many are small, family-owned businesses.

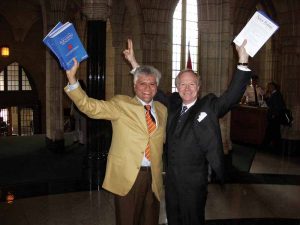

When at last a report on the tax from government relations firm Ernest & Young fell into the hands of John Duncan (then-MP for Vancouver Island North), victory was long overdue. A private member’s bill introduced by Duncan, combined with work on the part of Birks and Akkelian, provided the final push.

“For almost 90 years, our industry fought to have this prejudicial and hidden tax repealed. Finally, thanks to the ongoing efforts of two past presidents of CJA and a number of active CJA members, a private member’s bill led to the luxury tax being rescinded,” says Brian Land, CJA’s current general manager. “This action immediately allowed Canadian products to become more price-competitive—not only on the world stage, but also at home.”

Since then, the association has continually worked to address timely issues facing Canada’s jewellery sector.

“I see the CJA of the future being more member-centric and more consumer-focused,” says Land. “I see a truly national organization serving as the voice of the industry for all our stakeholders, members, consumers, government, and media.”