A hard-fought battle: CJA’s victory over the jewellery excise tax

by charlene_voisin | July 1, 2013 9:00 am

By Jonathan Birks and Pierre Akkelian

[1]

[1]At the end of the First World War, the Canadian government imposed taxes on a number of items to defray its substantial costs. Among them were so-called luxury (inelegantly defined as ‘non-essential goods’) taxes that were applied to products such as automobiles, radios, fishing rods (a sport of the privileged?), and all items the government broadly defined as jewellery. This latter tax was referred to as the jewellery excise tax (JET).

As a result of JET, the Canadian jewellery industry—which overwhelmingly comprised ‘Mom and Pop’ operations with very few employees—banded together in 1918 to form the Canadian Jewellers Association (CJA). Its mission was to establish a common national body to represent the industry in its efforts to lobby the government to rescind what was initially an administrative nightmare for jewellers. It is worth noting that in the years since the government imposed the excise tax, every other industry classified as luxury had come to be exempt, save for ours, making it unjust and prejudicial. It is also interesting to note most Canadians were not even aware of the tax’s existence, which was unfortunate, as this resulted in a lack of public pressure on the government to act.

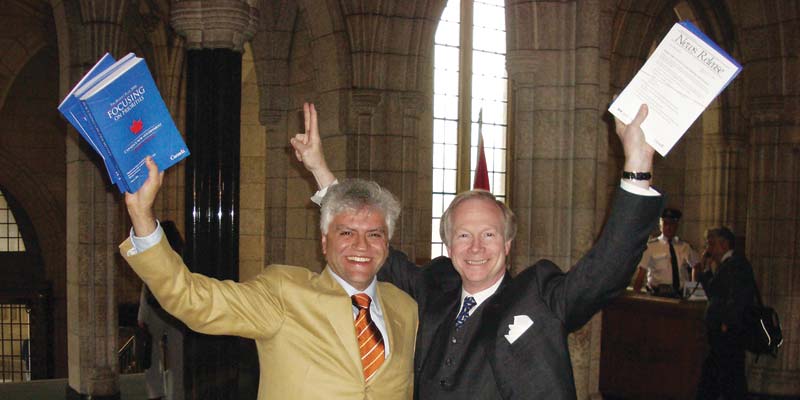

While there were intermittent attempts by the CJA over a 75-year period to eliminate JET, all were unsuccessful until 1993 when we were appointed consecutive chairs of the Government Relations Committee. This marked the beginning of CJA’s 13-year battle, which ultimately concluded with the Harper government rescinding the tax in May 2006.

During much of the 13 years, we worked in an atmosphere of overt doubt as to our ultimate success, both among our peers and those outside the jewellery industry. We spent considerable time in Ottawa, meeting with the finance minister, deputy ministers, senior members of the Department of Finance, and minister of revenue. We also attended numerous Standing Committees on Finance hearings in Montreal, Ottawa, and Toronto.

[2]

[2]We were so often in the Ministry of Finance offices that we very quickly became known among its staff. Indeed, at one hearing of the Standing Committee on Finance, a member suggested humming “I Got You, Babe” just prior to yet another of our presentations, a reference to the movie Groundhog Day and its storyline of living the same day over and over.

Our arguments were simple and factual. The excise tax made Canadian jewellery less competitive than foreign-made products imported into the country, forcing many Canadians to purchase similar items in markets like the United States. This was especially true in the case of Canadian diamonds, which were more expensive to purchase here than south of the border as a result of JET.

In arguing the tax was not truly a source of government revenue, we made the point that it was estimated approximately half the Canadian jewellery industry was selling ‘under the table.’ To counter the government’s perception that jewellers are wealthy because they cater to the luxury consumer, we informed them, much to the surprise of many, that Walmart was (and still is) North America’s largest single jewellery retailer, with an average sale at the time of less than $100 on a piece of jewellery.

We recognized the need for professional assistance in our efforts, which meant the introduction of lobbying firms, or in the current, more refined vernacular, government relations firms. We worked with a number of them. They cost money, we had no war chest. We hit the telephones and worked our industry from coast to coast to raise funds to afford professional assistance. And still the government would not move. Time and again, it promised to repeal the tax in the next budget. Each time, though, we were relegated to the bottom of the priority list, as more appealing items to voters at large nudged us from consideration.

Ernst & Young, one of the numerous professionals from whom we sought assistance, produced a report strongly supporting the CJA’s position. We circulated it to many in the government, but the white knight to our cause came in the form of John Duncan, a Conservative MP from British Columbia. He was also a member of a Natural Resources Committee studying the development of the Canadian diamond industry. John took our cause to heart and, through the introduction of a private member’s bill, successfully ensured JET’s elimination. It should be noted this was the first private member’s bill in the British parliamentary system used effectively to eliminate a tax.

Unlike past attempts by the CJA, we prevailed. One member of the finance department compared us to a small dog gripping onto a pant leg and not letting go. The stakes were quite high—the tax generated about $45 million every year during most of the 1990s. Before it was rescinded, JET brought in closer to $75 million annually, due to inflation and increases in raw materials, etc. (The excise tax was based on product value.)

Our efforts were collective. We were helped by a number of CJA executive team members, including Carmen Rivet, Michael Birchard, John Minister, Mo Charania, and Catherine Sproule, the association’s executive director at the time. Without their support and encouragement, our ultimate success would not have been possible. In the final analysis, we are convinced the jewellery excise tax’s elimination is the CJA’s greatest victory since its inception which, after all, was the very reason for its founding. We had come full circle.

Jonathan Birks (1999-2000) and Pierre Akkelian (1996-1997) are former presidents of the Canadian Jewellers Association (years indicated).

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/Flaherty-Budget-2006.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/Harper-Pierre-and-John-Duncan.jpg

Source URL: https://www.jewellerybusiness.com/features/a-hard-fought-battle-cjas-victory-over-the-jewellery-excise-tax/