By Alanna Campbell

Global events in 2024 have impacted the jewellery and watch industry in many ways, most notably the war in Ukraine prompting G7 Sanctions against Russian diamonds. While the industry eagerly awaits clarity on what comes next, the U.S. Presidential election is on all minds and will have global implications regardless of who wins. Here at home, interest rate increases have impacted spending habits in most categories. As we take a look at the year at large, remember: Change is inevitable, yet how you prepare for and respond to it makes all the difference.

Constrained versus unconstrained

Craig Patterson, CEO and publisher of Retail Insider says, “The impact of economic situations such as high interest rates can be insulated based on the market level.”1 According to a recent report from the Bank of Canada, “Households can be in one of two possible situations: Constrained or unconstrained [ . . .] Constrained households hold few assets and exhaust all their disposable income.”2 Retailers with low to mid-range products frequented by the average consumer may notice a drop in sales as constrained households struggle to make ends meet in the current economic climate.

High-end retailers are typically frequented by consumers from unconstrained households or those with enough savings that they can choose how much to spend.2 Patterson notes, “If a retailer is in the right location with high income or high net worth clientele, they may not notice changes in spending habits influenced by the market or cost of living.”1

The impact of high interest rates will have a lasting effect on Canadian households. The Bank of Canada reports, “The average increase in mortgage payments should peak at 17 per cent around 2027, when almost all mortgages that were outstanding in February 2022 will have been renewed [ . . .] Increases in interest rates have reduced the average mortgage borrower’s consumption by 2.8 per cent as of April 2024 and that the decrease is expected to fall further and reach 3.8 per cent in early 2028.”2 Retailers must be prepared to deal with reduced consumption in the coming years.

Adopting buy now, pay later

In a challenging sales environment, retailers must adapt to consumer buying habits to keep closing sales. One tool that is being employed by retailers is the “Buy Now, Pay Later” or “BNPL” concept which continues to increase in popularity. Platforms such as AfterPay, Flexiti, Sezzle, etc., allow eligible consumers to shop at a variety of retailers and make payments within a pre-determined timeframe at interest rates much lower than the average credit card. According to data compiled by J. C. Williams Group,3 9.3 per cent of consumers had used BNPL services as of October 2023—up from 6.6 per cent two years earlier—indicating a 40 per cent increase.4 BNPL usage is expected to continue growing, with the total payment value in the U.S. forecasted to reach $80.77 billion in 2024, a 12.3 per cent year-over-year increase.5 J. C. Williams Group adds that, “Consumers enjoy the benefits of interest-free and/or low interest payments, as opposed to higher interest rates on credit cards.”3

Who is using BNPL programs?

An NBC News article reports that 53 per cent of BNPL users are consumers aged 35 and under, while they comprise only 35 per cent of traditional credit card holders.6 Furthermore, 23 per cent of consumers with credit card scores below 600 and 21.6 per cent with scores between 600-650 used BNPL, compared to only 2.8 per cent with scores above 800.4 An article published by the Federal Reserve Bank of Boston highlights “Concerns about the potential risk of accumulating too much debt through BNPL, especially for financially fragile individuals.”4 Retailers offering BNPL programs can use the tempting credit terms for consumers to close the sale while eliminating the risks in-store financing options.

Leveraging online sales

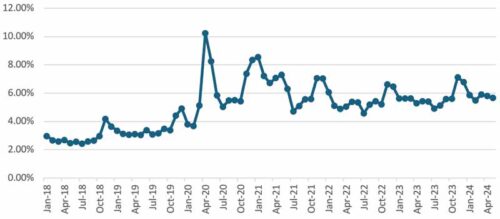

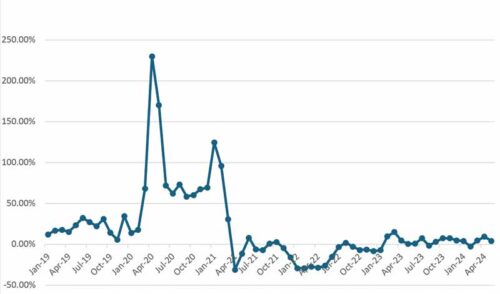

There is a common misconception that online sales have been the retail apocalypse. Although the pandemic did have a significant impact on how consumers shop, quite literally increasing demand for online retailers overnight, big purchases are still being made in-store. J. C Williams reports that “Canadian total online sales represent approximately five per cent of total retail sales. In the lockdown of the pandemic, total online sales hit 10 per cent. Canada still remains further behind in e-commerce than the U.S. and Europe. Except for the spike in the early pandemic months, e-commerce has realized very little change year-over-year.”3 See Figures 1 and 2.

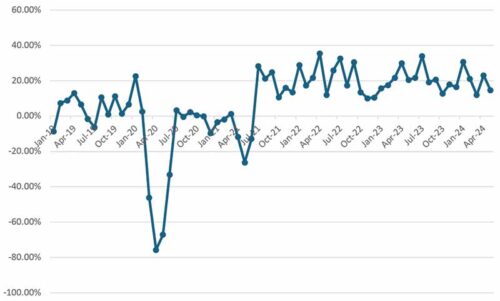

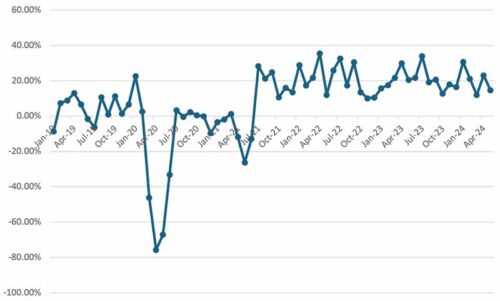

Savvy consumers are using websites and accompanying online stores to conduct preliminary research about available products and get an understanding of a company’s ethos. When it comes to making the final purchase, especially for special items such as engagement rings, consumers continue to crave the product interaction and immersive experience that comes with shopping in-store. Overall, jewellery sales have returned to stable levels after the pandemic induced spike in sales, as shown in Figures 3 and 4.

An immersive store experience

The in-store visit is not solely about seeing the product, it encompasses the entire buying experience. The first impression is made online when consumers click search and visits a retailer’s website or social media platforms. An easy to navigate website with up-to-date information and a call to action is necessary to reach the end goal. In an article published by The Centurion, author Emmanual Raheb, founder and CEO of Smart Age Solution, outlines the strategies retailers can use to increase their website conversion rate. Raheb states building trust and employing the use of live chats to capture the lead, noting “59 per cent of customers are more likely to purchase when brands answer their inquires in less than a minute.”7

Retailers who have successfully started to build trust with consumers through their online presence are more likely to have consumers visit their store in person.

What can retailers do to invite window shoppers in?

Interior design expert Leslie McGwire of Leslie McGwire & Associates states, in an article published in The Centurion, “A jewellery store entrance needs a visual hook that brings a customer’s attention to [the] store. The entrance should make the customer think ‘STOP! There is something here for [me]!’”8 McGwire continues, “Every time a customer walks through the door, their first impression causes them to form an immediate opinion about your business based on the jewellery store environment that they experience. In just a few seconds, customers will decide if your business is a well-designed and professional establishment.”8 Patterson also says, “Like the Broken Window Theory, shoppers will react to their environment. If the retailer looks like they aren’t trying, consumers will notice. Store design plays an important role in the in-store experience. Having design features that embrace the company’s heritage and add to the store’s character become an asset. Most importantly the store must be well maintained.”1

Hiring sales professionals

Consumers should also be greeted by a knowledgeable and professional staff. Information released by Statistics Canada in July shows that the Canadian unemployment rate had risen to 6.4 per cent as of June 2024.9 The increase in unemployment is primarily driven by slower hiring rather than layoffs, as population growth outpaces job creation.10 Employment growth has been weaker than expected, with Canada shedding 1,400 jobs in June 2024 against the expectation of a 25,000 job increase.11 The decline in participation is not due to fewer people looking for work, but rather an increase in the working-age population outpacing job creation.12 J. C. Williams notes, “The labour market in Canada is currently facing significant challenges, with persistent labour shortages and high job vacancy rates across various industries.”3 There were over one million vacant jobs in 2022, and 59 per cent of employers struggled to find qualified employees.13 Accommodation, food service, and retail trade sectors are among the top industries with the highest job vacancy.3

A retail jewellery sales professional is a unique individual that has the ability to establish trust and patiently walk clients through the process and successfully close the sale. They are highly professional and have extensive product knowledge. These individuals can be hard to find, with “Top talent often being recruited from the competition” says Patterson.1

How do you acquire and maintain top talent?

Providing a safe and pleasant work environment that encourages teamwork plays an important role in ensuring loyal employees who want to sell. Of course, in today’s economic climate compensation is more important than ever. According to talent.com, “The average jewellery store manager salary in Canada is $53,888 per year or $27.64 per hour and the average jewellery sales salary in Canada is $39,396 per year or $20.20 per hour.”14,15 It is important to note that total wages vary by location and these figures do not include the addition of commissions common in the retail jewellery industry. Wage growth in Canada remains elevated at 5.4 per cent year-over-year as of June 2024.11

Jewellery crime incidents

Crime incidents can also have an impact on employee retention. Incidents are often traumatic and make returning to the workplace challenging. According to Jewellers Vigilance Canada (JVC), “In the past two years, the bulk of smash and grabs have occurred around the Greater Toronto Area (GTA); however, in Q1 2024, JVC has recorded a number of these robberies in the Vancouver Lower Mainland (VLM). JVC predicts this new trend will continue in this area and increase.”16 JVC states, “Towards the end of the quarter, the robberies have slowed with several arrests in the GTA. Sophisticated break-and-enters (rooftop or side wall entry style with safe attacks/thefts) have been virtually nonexistent since 2020. However, JVC has recorded an upward trend in these events in Ontario in Q1. Opportunistic break and enters continue to occur.”16 It is imperative that retailers remove products from showcases at night as “Several [break and enters] have occurred at malls where jewellery is often left out overnight in showcases.”16

Although “grab and run thefts have reduced slightly but continue, there has been increasing fraud events occurring with the attempts to purchase jewellery over the phone, with switching parcel shipping destinations and also subjects impersonating courier services/drivers.”16 The entire jewellery community must remain vigilant and keep security protocols and equipment up to date to deter crime.

A new generation of jewellers

With the population aging, there is no doubt that the industry will see more and more knowledgeable and talented industry veterans retire. According to Bruce McDonald, president of Silverman Consulting & Retail Services, “In recent years, many of our clients are baby boomers (now aged 59-78), and many are ready to retire. Some may be second or third-generation owners of the business. Still, their children are not as likely to go into the family business as it was even a few years ago”.17 McDonald explains, “It is becoming more difficult every year to sell a brick-and-mortar independent retail store as is. If new retailers are coming into the space, they are likely looking for a smaller footprint and diversifying with a portion in online sales and more and more custom work”.17 For owners looking to retire with a succession plan, “Retirement sales for the current owners, [create] significant sales and clearing out all the aged and dead inventory, leaving a lean and clean stock [that] allows the next generation to make any adjustments.”17 McDonald says, “We have not seen as many relocations as in the past. Jewellery store owners are looking carefully at relocations and long-term leases”.17 When inquiries are received from undecided store owners, McDonald asks them one question: “Are you still having fun?” After all, jewellery is supposed to be fun!

No matter how things have changed, the jewellery industry continues to endure. The people that make up this industry are just as unique as its gems and jewellery. Those that continue to push the boundaries and respond to changes in a timely manner, can enjoy the fruits of their labour for years to comes.

References

1 https://retail-insider.com/?m=0

2 https://www.bankofcanada.ca/wp-content/uploads/2024/06/san2024-14.pdf

5 https://www.emarketer.com/insights/buy-now-pay-later-industry-challenges/

9 https://www.cbc.ca/news/business/june-labour-force-survey-1.7255140

11 https://economics.td.com/ca-employment

12 https://www.bankofcanada.ca/2024/06/what-labour-force-participation-tells-us-about-the-economy/

13 https://www2.deloitte.com/ca/en/pages/public-sector/blog/strengthening-canada-labour-market.html

14 https://ca.talent.com/salary?job=jewellery+sales

16 https://jewellerycrimecanada.ca/

17 https://silvermancanada.com/

With over ten years of experience in the jewellery industry, including her inaugural role as a Retail Sales Professional to earning her designation as a GIA Graduate Gemologist and Registered Master valuer Appraiser, Alanna combines her knowledge of the industry with her passion for gems and jewellery to proudly serve the industry today as the Membership Coordinator for the Canadian Jewellers Association.