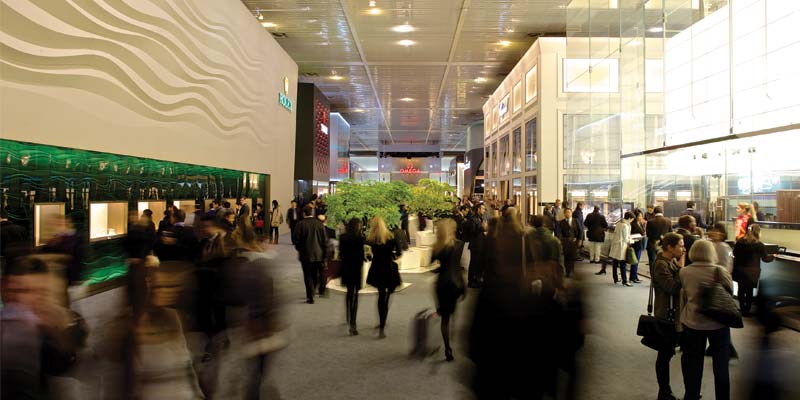

BaselWorld 2014

by charlene_voisin | July 1, 2014 9:00 am

By Jacquie De Almeida

Hakim El Kadiri walks the Rado booth at Baselworld with the air of a proud papa.

With a couple dozen watches peeking out from various wall and standalone cases, he knows them all, inside and out. And so he should.

As Rado’s head of product development, El Kadiri led the team that designed every detail, right down to the platinum anchoring diamonds into the ceramic case and bracelet of its latest ladies’ watch.

The crownless Swiss-made timepiece allows the wearer to set the time by moving a fingertip around the case—electrodes inside ‘feel’ the presence of the finger through the ceramic. And while some companies would have first developed a version to appeal to the tech-savvy male, Rado took a different route by releasing a ladies’ model last year instead.

“We wanted to combine elegancy with technology,” El Kadiri says. “Everyone has an iPhone and knows how to work it. The oval shape of the watch is very sensual and the ceramic is very warm.”

In the midst of unseasonably warm temperatures in the city where the Swiss, French, and German borders meet, the 42nd edition of Baselworld opened with less fanfare than last year when show organizers cut the ribbon on its 430-million CHF ($463-million Cdn) facelift. The makeover set the stage for what MCH Group—the fair’s organizer—described as a solid foundation for coming years. And it appears they were right.

While other segments of the market face challenges, the Federation of the Swiss Watch Industry (FH) says exports increased in January and February by 6.8 per cent.

Although figures remained flat for March year over year, FH says the first quarter of the year rose by 4.5 per cent to 4.95 billion CHF ($6.2 billion Cdn), providing a good start to 2014 for Swiss watchmakers.

As last year, the ladies’ category came to the fore, whether in mechanical or quartz offerings. More affordable styles among prestige brands appeared to be another noteworthy trend, as they court fast-growing middle and upper classes in emerging markets. Blue dials also seemed to be all the rage, whether as an anchoring piece to a collection or as a method of drawing consumers’ eyes to the watches around them.

John Burns, Davidoff’s commercial director, says the company’s latest offering is a blue model that was based on the company’s men’s fragrance. He adds, though, that watch brands in general are moving toward offering styles beyond silver, black, and white.

“This year in Europe, it’s all about colours—a range of colours is very prominent in our collections, whether it is in leather goods, scarves, or ties,” he adds.

The opening of the show comes about a month after 50.3 per cent of Swiss voters backed a proposal to curtail immigration from the European Union, a move meant to help control overcrowding. Some believe the vote could hit the watch industry especially hard, already affected by a shortage of skilled watchmakers to help support a sector that grows every year.

Omega president Stephen Urquhart says it’s too early to tell what effect the vote will have on the watch industry, but he adds he’s not expecting it will have a significant impact. Another topic of conversation thought to pose no threat to the Swiss watch industry, he notes, is the smartwatch.

“People will buy smartwatches for fun—I might even buy one,” Urquhart says. “But they will never replace a beautiful mechanical watch. Smartwatches may even be good for the industry because they will put watches on people’s wrists. For me, the bigger issue is people not wanting to wear a watch at all.”

Taking an objective look at consumer preferences is one way to remain in touch with trends. Sian Williams, president of Bulova Corp., says the company’s use of market research helped it determine what styles consumers were looking for at various price points. The results indicate a preference for an affordable fashion watch with the look of a higher-end piece. “The feedback we got really helped to tell us who we should be targeting, i.e. the younger consumer who is buying three to four fashion watches a year,” she adds.

Chris Iliopoulos, owner of Canadian distribution company, Sothil, says that while some companies are designing watches to keep price points down, others are incorporating more expensive features to appeal to an elite demographic.

“High-end retailers will adapt very quickly [to the price increase], while mid-range retailers need to adapt by having other brands to support a particular price range,” he says. “Surrounding a collection with limited-edition pieces can also help.”

Providing an assortment of product is especially important in a market like Canada, which has diverse tastes from province to province, says Rick Oquet, president of Axessimo International, which recently picked up the Davidoff line.

“In the United States, it’s all about depth,” he says. “They usually have a couple of styles and they have a lot of depth. In Canada, you have to have more styles. Some will fit in Ontario, some fit in Quebec, etc. But ultimately, the watches have to have an identifiable look, though with a different style.”

Swatch Group’s fight to scale back supplying movements and parts to the Swiss watch industry has been a topic of conversation at Baselworld over the last few years. A ruling last summer by the Swiss Competition Commission (Comco) that it cannot cut its supply of movements as much as previously thought came as a welcome relief to the industry. However, the move to ensure watch manufacturers are able to meet their own demands continues to gain steam.

Companies like Oris have worked to position themselves independent of Swatch Group with proprietary calibres. Louise Blain, Oris’s Canadian director of marketing and sales, says the company has been working on a movement for the last 10 years.

“We will never be fully independent from our supplier, Sellita, but we have a really good partnership with them,” she says, adding Oris’s movement has been in testing for the last 18 months. “If you only have in-house movements, your prices will go up drastically and that doesn’t fit with our company philosophy of offering a product anyone can purchase. You still need those $1500 price points.”

While the focus at Basel tends to be on things like movements and dial design, straps are not to be overlooked, particularly as replacement items.

“For the retailer, replacement leather bracelets are important because they can make the highest turnover of all the products they have in their store with the least amount of space,” explains Robert Hirsch, president and chief executive officer (CEO) of Hirsch.

“They are also an important loyalty program for retailers. A consumer does not shop for a new bracelet; they simply go to their trusted watch retailer. If the client is satisfied with this purchase, they will return to the same retailer when they need another bracelet.”

Social media continues to be one of the main marketing tools brands are using to get consumers to the counter. Mariaelena d’Agnese, export manager for Rodania, says that in addition to product news, the company’s Facebook page and Twitter feed look to engage younger consumers with contests, helping to build a brand that has traditionally been targeted to an older demographic.

Although being able to directly track sales as a result of social media is extremely difficult, d’Agnese says the aim is to build brand recognition. “You try to create awareness about the brand,” she says. “If you send this kind of message to your end user, it will impact retailers and distributors.”

Eric Senftleben, vice-president of planning and operations for Citizen Watch Company of Canada, says consumers naturally respond to meaningful brand philosophies. “You need to have an emotional connection with a brand,” he says. “It’s about explaining a feeling to people. That’s something we’ve always been very proud of. [More sales] come when people understand who you are as a brand. And when they get as emotional as we do talking about it, it’s the easiest thing to sell.”

Baselworld 2015 runs from March 19 to 26.

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/BASELWORLD2014_SSC_06_010.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/CS10113.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/Co169_Perla.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/RLS1403-01_SSE003.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/Casio_G-SHOCK_MTG-S1000BS.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/Velocity_Diver_Night_Dive_Edition_Rubber_Strap_white_high.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/EM0320-59D.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/Multislim_RoseGoldWhite.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/Chimera-43-Black-Beige.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/65B153.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/PR_Rado_Esenza_Ceramic_Touch_Jubilé_132_black_2.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/0606849w.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/2510629.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/W0289L1.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/11_110_7700_4081_LS_Set.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/VERSACE-V-SIGNATURE_white.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/K24_3610_front1.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/12/Andy.jpg

Source URL: https://www.jewellerybusiness.com/features/baselworld-2014/

[1]

[1] [2]

[2] [3]

[3] [4]

[4] [5]

[5] [6]

[6]

[7]

[7] [8]

[8]

[9]

[9] [10]

[10]

[11]

[11] [12]

[12] [13]

[13] [14]

[14] [15]

[15] [16]

[16] [17]

[17] [18]

[18]