Baselworld 2018: Staying afloat in a changing market

by carly_midgley | June 20, 2018 10:18 am

By Carly Midgley

[1]

[1]As Baselworld enters its second century, one might expect it to carry an atmosphere of celebration and optimism. Instead, however, a dramatically reduced show size, perceived slower foot traffic, and shorter duration brought a buzz of uncertainty to this year’s edition.

The show’s entire upper floor was closed off, and the event was shortened from eight days to six. The number of exhibitors was also chopped in half, declining to 650 from 1300 last year. Despite organizers’ claims the fair saw eight per cent more visitors over the first two days, the downsizing was keenly felt by a number of attendees.

“It didn’t seem to feel more crowded per foot, so I think the number of people showing up was quite a bit less,” said Fred Wenger, vice-president of operations for Québec-based Wenger’s Ltd. “I think trade shows in general are out of fashion in many industries, so it’s affecting our industry as well.”

However, according to René Kamm—CEO of Baselworld’s organizer, MCH Group Exhibition—this is all part of a larger, brighter plan. He says the shrinkage is an effort to prioritize quality of exhibitors over quantity.

“I believe Baselworld’s present dimensions with 650 brands are optimal,” Kamm said. “We now have a tailwind for 2019.”

On the show floor itself, the perception differed—several exhibitors cited the significant expense associated with attending the fair as the most likely cause of the drop, rather than an intentional restructuring.

“I think some of the smaller or emerging brands found the costs of setting up a booth prohibitive and had concerns about return on investment (ROI),” said Raynald Aeschlimann, CEO of Omega.

Sian Williams, president of Canadian watch distributor Kingsmen, expressed a similar sentiment.

“I believe the difference this year is largely indicative of the exorbitant costs of showcasing your brand in Basel, more so than troubles in the industry,” she said.

This appears to be true, if the latest statistics from the Federation of the Swiss Watch Industry FH are anything to go by. With exports achieving a year-over-year increase of 12.9 per cent in February, the Swiss watch trade, at least, does not appear to be suffering.

Meanwhile, the smartwatch—once hailed as a harbinger of doom for its mechanical counterparts—was largely absent from the show floor, according to a report from Strategy Analytics. Only a handful of wearables were on display.

“It’s like talking about a separate industry,” said Omega’s Aeschlimann. “Customers who love mechanical watches are not buying them because they are more practical than smartwatches. They buy them because they have a story behind them, and because of the exceptional skill it takes to make them. If you think of the difference between a vinyl record and an MP3, the digital file is clearly more practical, but it just doesn’t ignite the same kind of passion.”

Williams agrees, noting traditional watches have staying power the smartwatch lacks.

“Watches really punctuate those milestones in your life that you’re not going to celebrate with just any old thing,” she says. “It might be that you got that promotion, you just had a baby, or your hockey team won the championship this year. It’s not the time for a toaster. Not the time for a cell phone either, because a cell phone is going to be gone in a couple of years.”

That said, as demographics and technology offerings shift, it’s becoming more necessary for watchmakers to reconsider how they sell these evergreen products.

“The emerging generation is important to focus on, and though they are currently not the strongest buying force in the watch market, they will be eventually,” said Aeschlimann. “Obviously, the use of social media and e-commerce is vital.”

“The most relevant ROI you’re going to get from social media is you’ll be talking to customers you would not normally be talking to,” added Williams. “You’re casting a wider net and getting a demographic you typically don’t with traditional marketing.”

However, this does not mean abandoning traditional marketing altogether. Instead, exhibitors say it is crucial to balance the new innovations customers demand with more time-tested approaches.

“We’re always interested in looking at new ways to communicate with customers—but not at the expense of the more traditional methods that still appeal to many,” said Matthias Breschan, CEO of Rado.

Wenger echoes this sentiment, touching on the sometimes-substantial gap between what customers say they want and what they buy.

“There are always people seeking newer, unique products. Whether they’re successful and selling out is a different question,” he warned. “That’s quite a doubtful situation. You seek something different, yet you’re taking a big financial gamble, because your bread and butter items are the same model you had for many years and they’re performing. It’s like a risky balancing act.”

Indeed, Aeschlimann says products that have a longstanding legacy did particularly well at this year’s show, with their renown providing as much appeal as their design features.

“At Baselworld, there was strong interest in the reissues of two of our classic watches,” he said. “These are not fickle or fashionable new designs. They have strong connections to the past, yet the modern consumer is fascinated by them.”

Williams noted recent popular designs are also trending toward simplicity.

“Clean, simple, round dials seem to be the strength of the moment with the modern consumer,” she said.

“Most companies’ successful items have basic styling,” said Wenger. “Automatic watches are doing well, and watches with full Arabic digits on the dial are always good. There’s also a movement toward domed crystal and glass.”

This is not to say newer, more unique designs are completely out of the running. Breschan, for example, says Rado’s more recent models also performed well at the show.

“New materials in new colours with new design approaches and different and interesting movements have proved very popular,” he said.

Armed with strong legacies, new innovations, and emotional appeal, it seems the watch industry sees no reason to panic—yet.

“We’ve certainly had a challenging few years, but we’re seeing some positive upward trends and it’s important we don’t get caught in the trap of comparing current sales against boom years, as that’s not realistic,” said Aeschlimann. “In terms of the market in general, I think we’ll see modest but steady growth.”

However, Baselworld’s shrinkage has certainly not been overlooked. The industry is recognizing the shift for what it is: a sign of the times, and an indication the ability to adapt will be critical going forward.

“The dust of this most recent change has not settled yet,” said Williams. “People still want to go out, they want to be engaged, but they’re demanding more when they go shopping. If you’re not going to give me some other dimension of understanding your brand or your product when I go to see it, I’ll just order you online. Why should I go out?”

As for Baselworld itself, optimism persists the show will survive its downsizing and continue to stand as a keystone event for the watch industry. Although many visitors have dropped out due to the absence of their regular suppliers, Wenger, for instance, says he will continue to attend.

“It doesn’t make total sense because they can, with their extra time, go see newer suppliers—they don’t always have to go to the same places and meet the same people,” he says. “That’s the nice thing about trade shows. It’s a good meet and greet for seeing new products.”

Baselworld will return again next year, running March 21 to 26.

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/15BW2018HALL11DOB083206503.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/Rado-Hyperchrome-UltraLight.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/AL-525G4TS6B.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/98C131_FEATURE_01_rgb.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/M116595RBOW-0001_PK13_001.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/01-114-7746-4063-Set-1-22-7.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/311-92-44-30-01-001-jpg.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/FC-200MCD14.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/DW00100163.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/AV0071-03A_Beauty_4x6.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/10234-3O-BUIN.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/Globetrotter.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/L3.727.4.76.jpg

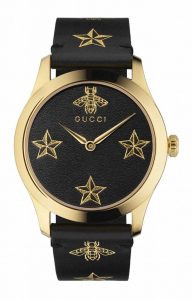

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/YA1264055_RGB.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/HD_Artya_SonOfEarthButterfl.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/411-cf-8513.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/HD_TAG_Heuer_Carrera_Heuer_.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/Happy_Sport_-_274893-5010_1.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/HD_Mido_CommanderBigDate_01.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/Navitimer_8_B35_Automatic_U.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/HD_DeGrisogono_Allegra25_03.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/CIBLR-E91.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/06/AIKON-AUTOMATIC-SKELETON_PR.jpg

Source URL: https://www.jewellerybusiness.com/features/baselworld-2018-staying-afloat-in-a-changing-market/

[2]

[2] [3]

[3] [4]

[4] [5]

[5] [6]

[6] [7]

[7]

[8]

[8] [9]

[9] [10]

[10] [11]

[11] [12]

[12] [13]

[13]

[14]

[14] [15]

[15] [16]

[16] [17]

[17] [18]

[18]

[19]

[19] [20]

[20] [21]

[21] [22]

[22] [23]

[23]