Comes out in the wash: Why complying with Canada’s anti-money laundering rules makes good business sense

by jacquie_dealmeida | June 14, 2016 9:00 am

By Marc Lemieux

It’s not often Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) makes national headlines, but it did just that in April.

It’s not often Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) makes national headlines, but it did just that in April.

The story referred to a controversial decision not to release the name of a bank fined more than $1 million for various infractions under Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). However, it also called attention to the public naming of two members of the jewellery industry for similar violations and the seeming unfairness regarding the disclosure. It’s the first time a penalty—$12,775 for one jeweller and $13,500 for the other—has been levied against a dealer in precious metals and stones (DPMS). It may also be signalling a crackdown by FINTRAC to ensure compliance in general, and more particularly, within the jewellery industry. As such, a review of PCMLTFA may be in order.

Slow to adopt

Although PCMLTFA has been in place since 2000, Canada’s compliance among DPMSs has been deemed woefully inadequate on several fronts, some of which was covered in an article appearing in the December 2014 issue of Jewellery Business. The act was developed in response to recommendations made by the Financial Action Task Force (FATF), an inter-governmental body tasked with setting standards and promoting the effective implementation of legal, regulatory, and operational measures for combatting money laundering, terrorist financing, and other related threats to the integrity of international financial markets.

In 2003, FATF observed the diamond industry showed “considerable vulnerability” to be exploited for money laundering and terrorist financing. The group also found diamonds offer “high intrinsic value in compact form” and can be traded “with little difficulty worldwide.” In addition, FATF noted the ease with which diamonds can be hidden and transported.

Although banks and other financial institutions were already required to meet regulations for combating money laundering and terrorist financing, FATF proposed in 2003 to extend the regime to all DPMSs and other designated non-financial businesses and professions.

As a member of FATF, Canada extended the scope of PCMLTFA and its regulations to DMPSs in 2008. Canada’s diamond industry and other DPMSs have now had eight years to adapt to the act and regulations. While the concerns expressed by FATF in 2003 remain valid today, it appears achieving compliance still remains a challenge for this sector.

Cracking down on crime

In a report issued in 2013 dealing specifically with the diamond industry, FATF reiterated “the diamond supply chain at all of its stages, from production to consumption, can be the gateway to profitability, for laundering proceeds of crime, for money laundering or terrorist financing, and for moving proceeds of crime into the financial system.” Although FATF adopted specific recommendations to mitigate the vulnerability of this industry, it remarked “several countries have not yet implemented these in their national anti-money laundering and counter-terrorist financing (AML/CTF) legislation,” and “[in] those countries that do have national AML/CTF regulation on diamond dealers, the overall compliance is assessed to be medium”¦ Although there are supervisory authorities, no sanctions were imposed in the last two years, an indication of the low level of enforcement in the sector.”

In Canada, FINTRAC is the government body responsible for the enforcement of PCMLTFA and its regulations. In its 2014 annual report, FINTRAC shared FATF’s concerns over the high vulnerability of the DPMS sector to money laundering and terrorist-financing risks, as well as the sector’s low level of regulatory compliance as a whole. FINTRAC noted the vulnerabilities “reside in the fact precious metals are easily converted into cash and often transferred with minimal audit trails, making them attractive to criminals.” FINTRAC also found:

“This sector typically includes smaller entities with limited resources, compliance, experience, or industry association representation. Following our compliance examinations in this sector over the past two years, we have seen industry-wide non-compliance, particularly with respect to common regime elements that were often completely absent or,

if in place, incomplete or inadequate. Over the coming year, we will continue to increase our awareness and assistance activities while beginning progressive and measured enforcement actions within this sector.”

The concerns for the sector’s vulnerability to money laundering and terrorist financing are shared by the Department of Finance Canada. In a recent assessment of inherent money laundering and terrorist-financing risks in Canada’s financial systems, it rated the DPMS sector as posing “high” vulnerability. With respect to this sector, Department of Finance described the reasons for its risk assessment as follows:

“There are a large number of DPMSs located across Canada, from very large to very small dealers, that are highly accessible to domestic clients and, in some cases, international clients (e.g. through online sales). DPMSs conduct a large volume of business in high-value commodities that are vulnerable to money laundering and terrorist financing. DPMSs have largely transactional relationships with their clients and there are opportunities for clients to conduct cash transactions with a high degree of anonymity. It is also believed the client profile includes high-risk clients, notably those in vulnerable businesses or professions. DPMS is a highly accessible sector where there are high-risk clients who can purchase high-value commodities for cash relatively anonymously.”

The verdict? High risk and poor industry-wide compliance. What can the diamond industry and other DPMSs expect in the future? In the same report, FINTRAC provided the answer: “progressive and measured enforcement actions.” The penalties imposed in April are a clear signal FINTRAC walks the talk.

What does this mean?

In the years following its creation, FINTRAC’s compliance efforts were focused on awareness and outreach, with the view compliance could be achieved through education and support.

Over the years, however, this approach has matured. While FINTRAC continues to provide education and support, it now undertakes a series of enforcement actions that are adapted to the sector’s underlying level of knowledge of its obligations and compliance behaviour, as well as the risks associated with non-compliance.

These enforcement actions include:

- observation letters;

- reporting entity validations;

- reports monitoring;

- compliance meetings;

- compliance assessment reports;

- examinations;

- follow-up examinations;

- administrative monetary penalties; and

- non-compliance disclosure to law enforcement.

FINTRAC monitors the reports it receives from reporting entities. If potential non-compliance is found, it can issue observation letters and follow them up with the reporting entity to ensure remedial action has been taken. FINTRAC uses reporting entity validations to confirm whether potential reporting entities are indeed covered by the act and regulations.

Compliance assessment reports are used where FINTRAC has evaluated the risk of money laundering and terrorist financing to be lower, although this would not be the case in the DPMS sector. These assessment reports are used in lieu of examinations and consist of pointed questions businesses are required to answer.

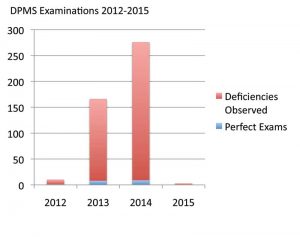

Examinations are the primary instruments for assessing and enforcing compliance. Between 2011 and 2015, FINTRAC conducted 454 examinations of reporting entities in the DPMS sector. As noted earlier, these examinations revealed industry-wide deficiencies in compliance.

When significant or very significant non-compliance is identified, FINTRAC works to ensure proportionate and tailored enforcement actions are taken. These could include compliance meetings and follow-up examinations. However, they could also take the form of administrative monetary penalties.

In 2008, PCMLTFA was amended to give FINTRAC the power to levy administrative monetary penalties. These penalties can range up to $1000 for violations not deemed serious, and up to $100,000 and $500,000 in the case of serious or very serious violations, respectively. To date, FINTRAC has levied such penalties against 74 reporting entities, including two DPMSs.

In the most egregious cases of non-compliance, FINTRAC can disclose a matter to law enforcement agencies for potential penal sanctions. This is generally reserved for situations where a reporting entity is either complicit in or “willfully blind” to money laundering or terrorist financing activity.

Avoiding FINTRAC’s ‘hall of shame’

No one in the diamond industry wants to see its non-compliant behaviour sanctioned by an administrative penalty, referred to law enforcement agencies for potential prosecution, and/or posted to FINTRAC’s online ‘hall of shame,’ so to speak. The monetary hit of an administrative penalty is bad enough, and each of these administrative and penal sanctions come with legal fees, not to mention the blow to a business’s reputation.

Whether in the DPMS sector or sectors to which PCMLTFA and its regulations apply, good compliance is good business.

If your business has been examined, now is the time to act on any observations made by FINTRAC and correct noted deficiencies. Consult with compliance experts and consider moving toward compliance best practices. If your business has not yet been examined, consider conducting an independent audit of your compliance program and procedures. Be ready when FINTRAC comes knocking on your door.

Marc Lemieux is an experienced Quebec and Ontario lawyer specialized in banking, finance, and payment law. He acts for clients in court cases, commercial transactions, and compliance matters. Lemieux assists DPMSs in developing compliance regimes and advises on matters related to FINTRAC. He can be contacted via e-mail at marc@marclemieux.com.

Source URL: https://www.jewellerybusiness.com/features/comes-out-in-the-wash-why-complying-with-canadas-anti-money-laundering-rules-makes-good-business-sense/