A quick word regarding memo stock. When it comes to inventory management, as opposed to financial management, the question of who owns the product is irrelevant (i.e. you in the case of asset inventory or your vendors in the case of memo). The main thing to keep in mind regarding memo inventory is how it performs. In other words, if a product doesn’t sell, it doesn’t matter that someone else owns it—it’s no good and taking the place of something else that could be turning for you. So expect the same performance from memo as you would from your own asset inventory.

Having taken these factors into account, you are now ready to calculate your OIL; keep in mind, however, that GMROI is not an exact science, but rather a rule of thumb.

Also, remember it’s difficult to sell what you don’t stock. In other words, investment precedes dividend. Think of it this way: you don’t earn interest from your bank until you deposit money. The same concept applies to a retail environment.

Arguably, it’s possible to achieve a GMROI of 200, meaning earning $200 of gross profit per annum from every $100 invested in inventory. This should be the basis for calculating your OIL if you are striving for ‘best practice.’ However, given most stores are likely achieving well below this, a more realistic rule of thumb for a growing retail business is that every $1 of well-chosen, well-managed inventory can produce between $2.50 and $3.00 of retail sales per annum (excluding repairs, custom designs, and special orders).

What this means is if your inventory level is $400,000, you should be achieving between $1 million and $1.2 million in retail sales from finished product.

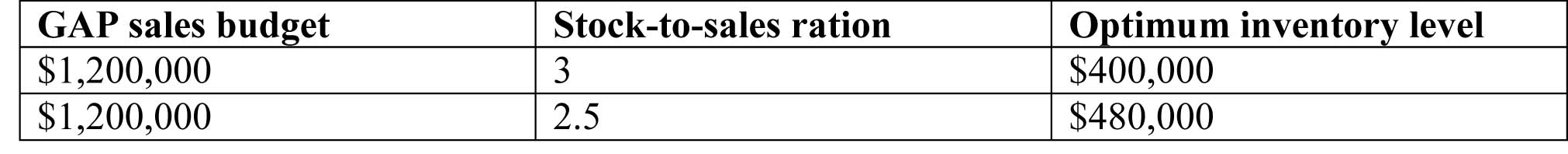

Looked at another way, if your GAP sales budget is $1.5 million and you do 20 per cent of your sales from repairs, custom designs, and special orders, your sales of finished product would be $1.2 million and OIL would be between $400,000 ($1.2 million divided by 3) and $480,000 ($1.2 million divided by 2.5).

Anything less than this level of performance and you are likely underperforming, which means you either need to address the lack of sales compared to inventory or the excess inventory you have on hand. Our preference is you consider both before deciding on a strategy, since inventory is often not the real problem—a lack of sales is.

Now that you have this information, what should you do?

1) Note changes to your business circumstances as outlined.

2) Calculate your optimum inventory level as explained.

3) Calculate your inventory GAP by comparing your OIL with your current inventory level.

4) Based on your inventory GAP, determine whether your strategy moving forward will be to increase sales, reduce inventory, or both.