A good turn

Now that you understand how much inventory you need, it’s time to calculate inventory requirements in each category. Let’s look at GMROI and how to calculate your OIL for each product category.

GMROI is equal to markup multiplied by stock turn. For example, if your markup is 100 per cent (which is a 50 per cent gross margin) and your stock turn is 0.8, your GMROI is 80 (i.e. 100 multiplied by 0.8). Your inventory management software should show your stock turn, broken down by category and vendor. If it doesn’t, a formula of Cost of Goods Sold (COGS) over Cost of Inventory (COI), will calculate it e.g. if your COGS for the year is $480,000 and your inventory level is $600,000, you have a stock turn of 0.8 ($480,000 divided by $600,000).

What this means in real terms is for every $100 you have invested in inventory, you are generating $80 of gross profit per annum.

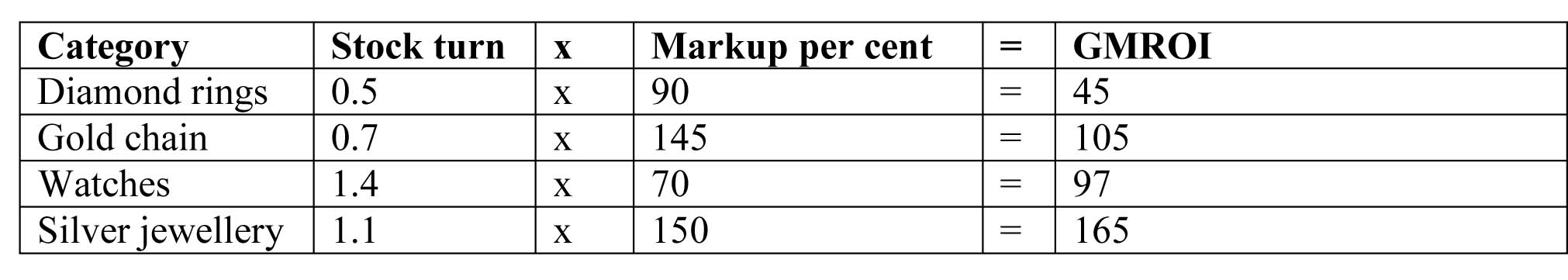

Here’s how GMROI works within a jewellery store:

Again, these are neither recommended figures nor are we suggesting you throw out your diamond rings and replace them with silver because you also need to consider your return on effort (ROE).

So in practical terms, GMROI is the only way to genuinely compare the performance of one category against another. We often hear retailers complaining about markup and threatening to drop a product line that in reality has a better GMROI than other products with a higher markup.

How does this help you calculate OIL for an individual product category?

Well, following our example of GAP sales of $1.2 million, let’s say 10 per cent of your sales are currently coming from diamond rings and you want this to increase to 12 per cent this year. Twelve per cent of $1.2 million is $144,000 of diamond ring sales.

Let’s also say you intend to increase your markup on diamond rings to 100 per cent and achieve a stock turn of 0.8 (meaning, on average, you expect them to take 15 months to sell), the OIL calculation would look like figure 1.

In the example above, you would have $13,000 (i.e. the difference between budgeted inventory and current inventory of diamond rings) to invest in diamond rings. Alas, there is a little more to it than that, as you are already arguably overstocked by $119,302 (i.e. the difference between budgeted inventory and current inventory in all categories). Remember, another way to look at it is you have enough inventory to do almost $1.8 million in sales (current inventory x stock-to-sales ratio of 3). I’d prefer to see you grow into your sales potential, rather than shrink your inventory and restrict future growth.