Good stock: Taking the guesswork out of stocking your store

by Katie Daniel | December 16, 2016 2:25 pm

By David Brown

When it comes to determining your optimum inventory level (OIL), the first thing to keep in mind is it doesn’t start with how much product you have in your showcases. In fact, there are a few things you must ascertain before you can accurately calculate your OIL. More about these shortly.

What do I mean by optimum inventory level? Well, OIL is the right amount of inventory to provide customers the best possible choice, while giving the retailer the maximum return on their investment—without affecting future sustainable sales growth.

Calculating your OIL starts by understanding your retail business is simply a ‘tool’ to help you achieve your living and wealth needs, both now and in the future. This is what I mean when I refer to GAP analysis. GAP is not an acronym; instead, it is a metaphor to describe the difference—the gap—between how you stand financially, compared to where you need to be.

Fall into the gap

Also referred to as the ‘bottom up’ budget, the GAP process comprises the following four steps:

1) GAP analysis (i.e. retirement/exit planning, including succession planning; personal exertion, such as your own market salary; return on investment, which is different from Gross Margin Return on Investment [GMROI]; and other operating expenses);

2) Gross profit GAP;

3) Sales GAP; and

4) Inventory GAP.

Only once careful consideration has been given to the first three steps, can you answer the question, “How much inventory do I need to achieve my sales budget?”

I know the idea of basing your sales budget on all these factors can be a little daunting or even downright overwhelming, but it is truly the only way to determine a meaningful OIL.

Assuming you have a good grasp of what your own GAP analysis would reveal and you have been able to calculate your gross profit GAP and sales GAP based on that, we are ready to continue to the fourth step and answer the question, “How much inventory do I need to achieve my sales budget?” Given this is a complex and highly important process, we will break it down into smaller steps.

When calculating your optimum inventory level, it is important to take into account other business circumstances. Consider the following:

1) Is your business growing, static, or declining?

2) Are you thinking about including new product ranges in your ‘buying plan’ to boost certain areas of your business?

3) Are you planning to drop certain product lines that no longer fit your business model or market position?

4) Do you have categories indicating a below-average GMROI, but deliver a high Return on Effort (ROE)?

5) Since you don’t need inventory for custom work, special orders, scrap gold, and repairs, what percentage of your total sales volume comes from these income streams?

6) How quickly can you replace your fast sellers?

A quick word regarding memo stock. When it comes to inventory management, as opposed to financial management, the question of who owns the product is irrelevant (i.e. you in the case of asset inventory or your vendors in the case of memo). The main thing to keep in mind regarding memo inventory is how it performs. In other words, if a product doesn’t sell, it doesn’t matter that someone else owns it—it’s no good and taking the place of something else that could be turning for you. So expect the same performance from memo as you would from your own asset inventory.

Having taken these factors into account, you are now ready to calculate your OIL; keep in mind, however, that GMROI is not an exact science, but rather a rule of thumb.

Also, remember it’s difficult to sell what you don’t stock. In other words, investment precedes dividend. Think of it this way: you don’t earn interest from your bank until you deposit money. The same concept applies to a retail environment.

Arguably, it’s possible to achieve a GMROI of 200, meaning earning $200 of gross profit per annum from every $100 invested in inventory. This should be the basis for calculating your OIL if you are striving for ‘best practice.’ However, given most stores are likely achieving well below this, a more realistic rule of thumb for a growing retail business is that every $1 of well-chosen, well-managed inventory can produce between $2.50 and $3.00 of retail sales per annum (excluding repairs, custom designs, and special orders).

What this means is if your inventory level is $400,000, you should be achieving between $1 million and $1.2 million in retail sales from finished product.

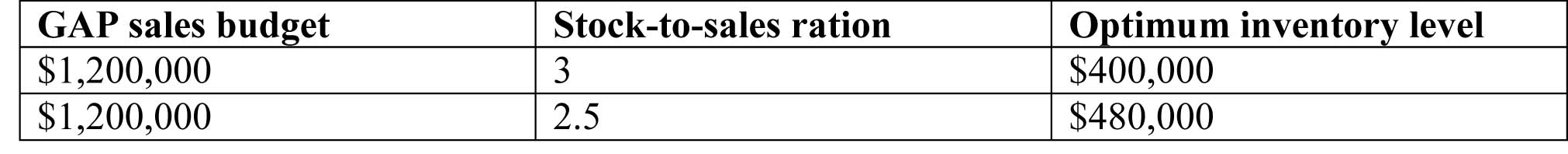

Looked at another way, if your GAP sales budget is $1.5 million and you do 20 per cent of your sales from repairs, custom designs, and special orders, your sales of finished product would be $1.2 million and OIL would be between $400,000 ($1.2 million divided by 3) and $480,000 ($1.2 million divided by 2.5).

Anything less than this level of performance and you are likely underperforming, which means you either need to address the lack of sales compared to inventory or the excess inventory you have on hand. Our preference is you consider both before deciding on a strategy, since inventory is often not the real problem—a lack of sales is.

Now that you have this information, what should you do?

1) Note changes to your business circumstances as outlined.

2) Calculate your optimum inventory level as explained.

3) Calculate your inventory GAP by comparing your OIL with your current inventory level.

4) Based on your inventory GAP, determine whether your strategy moving forward will be to increase sales, reduce inventory, or both.

A good turn

Now that you understand how much inventory you need, it’s time to calculate inventory requirements in each category. Let’s look at GMROI and how to calculate your OIL for each product category.

GMROI is equal to markup multiplied by stock turn. For example, if your markup is 100 per cent (which is a 50 per cent gross margin) and your stock turn is 0.8, your GMROI is 80 (i.e. 100 multiplied by 0.8). Your inventory management software should show your stock turn, broken down by category and vendor. If it doesn’t, a formula of Cost of Goods Sold (COGS) over Cost of Inventory (COI), will calculate it e.g. if your COGS for the year is $480,000 and your inventory level is $600,000, you have a stock turn of 0.8 ($480,000 divided by $600,000).

What this means in real terms is for every $100 you have invested in inventory, you are generating $80 of gross profit per annum.

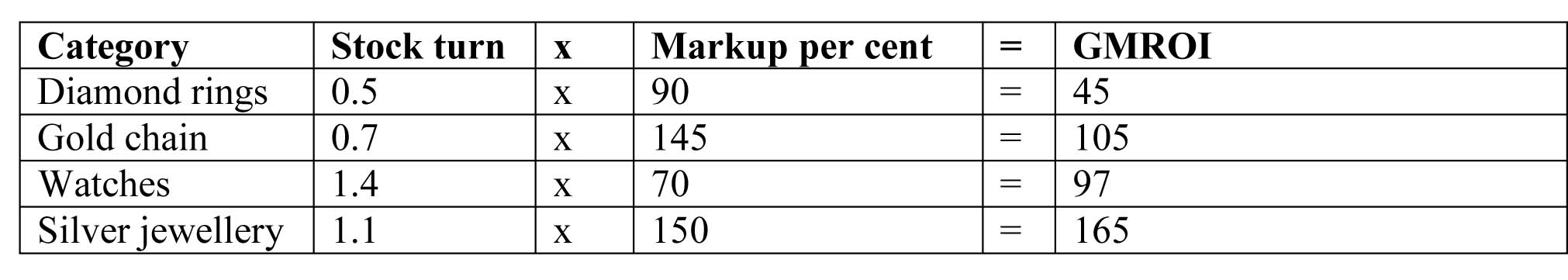

Here’s how GMROI works within a jewellery store:

Again, these are neither recommended figures nor are we suggesting you throw out your diamond rings and replace them with silver because you also need to consider your return on effort (ROE).

So in practical terms, GMROI is the only way to genuinely compare the performance of one category against another. We often hear retailers complaining about markup and threatening to drop a product line that in reality has a better GMROI than other products with a higher markup.

How does this help you calculate OIL for an individual product category?

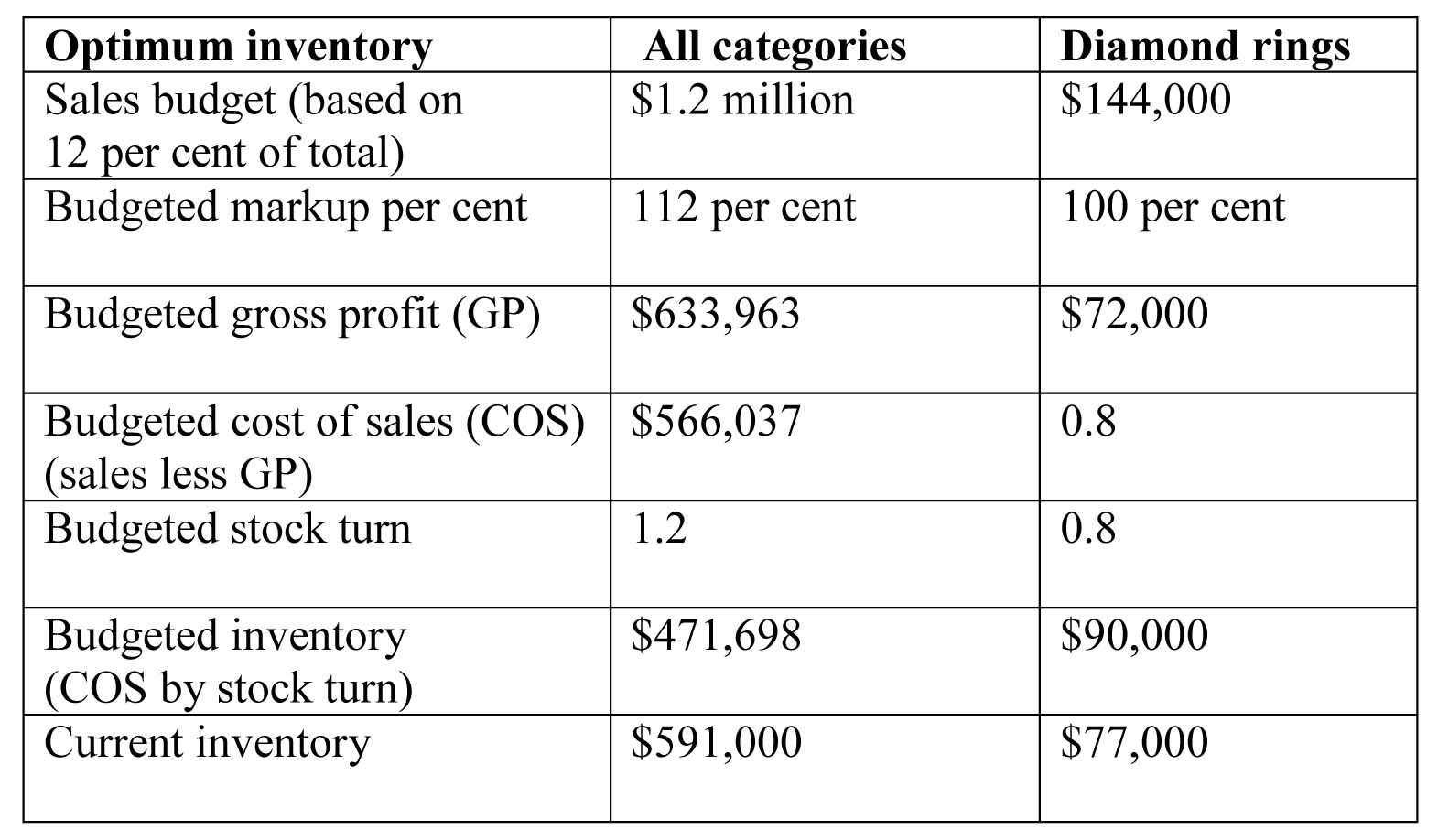

Well, following our example of GAP sales of $1.2 million, let’s say 10 per cent of your sales are currently coming from diamond rings and you want this to increase to 12 per cent this year. Twelve per cent of $1.2 million is $144,000 of diamond ring sales.

Let’s also say you intend to increase your markup on diamond rings to 100 per cent and achieve a stock turn of 0.8 (meaning, on average, you expect them to take 15 months to sell), the OIL calculation would look like figure 1.

In the example above, you would have $13,000 (i.e. the difference between budgeted inventory and current inventory of diamond rings) to invest in diamond rings. Alas, there is a little more to it than that, as you are already arguably overstocked by $119,302 (i.e. the difference between budgeted inventory and current inventory in all categories). Remember, another way to look at it is you have enough inventory to do almost $1.8 million in sales (current inventory x stock-to-sales ratio of 3). I’d prefer to see you grow into your sales potential, rather than shrink your inventory and restrict future growth.

Armed with the information you’ve calculated, consider the following:

1) Decide what your business is going to look like in the next 12 months. For example, consider which categories you are going to build and which ones you are going to reduce (if any).

2) Determine what GMROI you expect for each category. Remember, this is a combination of your markup and stock turn in each category.

3) Using these figures, calculate your optimum inventory level in each category. Do one at a time and start with the categories that can make the greatest amount of difference in the shortest amount of time.

4) If you are already overstocked in a category, decide whether you will increase your sales budget to match your inventory or reduce your inventory.

5) If you are understocked in a category, look at other categories that may be overstocked and work out how you can redeploy the investment where it’s needed.

6) Before rushing out and buying blindly, think carefully about the price points and margin you want to achieve, the image you want to create, and the vendors you want to partner.

Although this may seem to require a lot more science and discipline than you may have used to this point, if you are truly serious about the future profitability of your business, there is no other way to do it. Your business, your family, and potentially your retirement aspirations are at stake.

Consider this, if you were heavily invested in the stock market and one company’s stock was giving you a 30 per cent return on your investment compared to other companies’ stocks only achieving 10 per cent and assuming all other risk factors were the same, how long would you leave it before repositioning your portfolio? Your inventory is your investment portfolio.

David Brown is president of the Edge Retail Academy, a retail jewellery business consulting company that examines all the pieces of your business puzzle and creates a customized plan of strategies to grow your business. He can be reached at (877) 569-8657 or inquiries@edgeretailacademy.com[1].

- inquiries@edgeretailacademy.com: mailto:inquiries@edgeretailacademy.com

Source URL: https://www.jewellerybusiness.com/features/good-stock-taking-the-guesswork-out-of-stocking-your-store/