New technology brings new opportunities

by charlene_voisin | May 1, 2015 9:00 am

By Gary Dawson

[1]

[1]

I once wrote a survival guide for a U.S. jewellery trade publication intended to help first-time visitors get the most out of attending the Tucson Gem and Mineral Show. As I have never attended the International Consumer Electronics Show (CES) in Las Vegas, I could have certainly used something like that to help get me through the three days I spent there. Consider the following figures: more than 204,387 m2 (2.2 million sf) of exhibit space; 24 km (15 mi) of show floor; over 3600 exhibitors; and more than 20,000 products on display. You can imagine navigating those aisles as one of over 170,000 attendees was a potentially intimidating experience.

Since there was no way I was going to see all CES 2015 had to offer in the short period I was there, I ended up following my own advice: to simply focus on the venues and products I thought might hold the most interest for those of us in the jewellery industry. As it happens, these turned out to be products that might help us in either retailing or manufacturing and new innovations in wearable technology.

A snowball effect

[2]

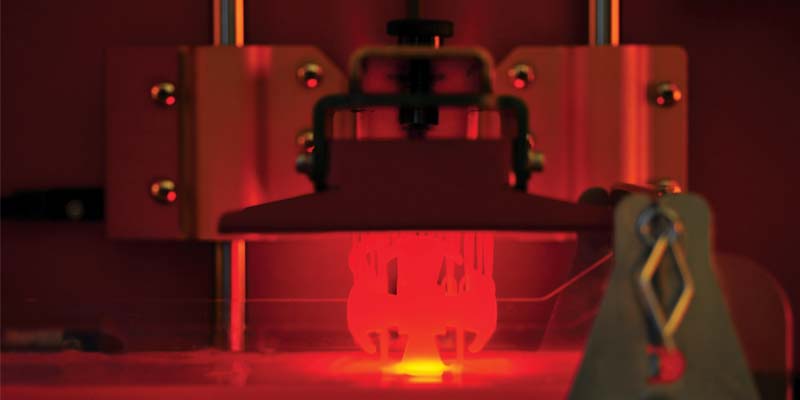

[2]There is a virtual tsunami of utility within the jewellery industry regarding innovation in manufacturing technology. From laser and impact engraving to additive manufacturing (AM), newer and updated existing technologies are helping to bring the all-important ability to rapidly prototype and customize into the more traditional light-manufacturing and designer-to-retail environment. (You’ll find jewellery-specific examples on these pages.) I have extensive experience with AM (more commonly referred to in the jewellery industry as 3D printing), so I spent a disproportionate amount of my time perusing this particular area of CES.

In keeping with technology research firm Gartner’s ‘hype curve’ concept, we have observed sporadic adoption of AM by the jewellery industry despite a great deal of media attention about how it would change our lives. As newer technology has become more available and cost-effective, it seems many manufacturers within our industry, both large and small, have arrived at the plateau of productivity. But many more have yet to discover this useful technology.

[3]

[3]Statistics for market potential in the jewellery industry are scarce, but I think a realistic guess would put AM as having penetrated far less than 20 per cent of the entire worldwide jewellery industry market. This seems to be confirmed by statistics reported by Phil Reeves, principal consultant for Econolyst Ltd. He says the use of AM today is less than 13 per cent of the G8 opportunity and less than 1.1 per cent of the total G20 opportunity. These statistics may provide insight for a progressive retailer. AM technology has, in a very real sense, reached its own stage of maturity—the technology is much more accessible now in both cost and utility. However, from the user’s standpoint, there is still a learning curve involved in adopting it, which may impede or delay some traditional retailers. For others, it may become a springboard to increased sales.

As such, I believe there is or will be a snowball effect driving this technology deeper into our industry. There is an ongoing trend toward customization in many consumer segments; to satisfy the public’s desire for the unique, jewellery retailers can pursue the ability to design for and with their clients. A feedback loop occurs as more consumers see the precision and detail made possible by AM and they then bring the desire for that precision into your retail environment. Migrating these services in-house with the addition of a designer or designer/goldsmith can offer a retailer an advantage in terms of time and cost over using a service bureau and an outside manufacturing facility, provided there is a beneficial return on investment (ROI).

With it with wearables

[4]

[4]There was a huge selection of wristwatch-like devices with the ability to monitor biometrics, mostly designed for people who wanted to maintain or keep track of a certain level of activity. While these wearable tech devices will possibly hold great interest to those involved in professional athletics or who just want to track their workouts, I question this technology’s appeal to a broad consumer base, barring one particular noteworthy exception.

No discussion about smartwatches can exclude Apple. Although the company did not exhibit at CES, its introduction last fall of the Apple Watch created huge buzz. This device—which at the time of this article’s writing had yet to be released—combines many functions, including timekeeping, biometrics, and communications technology, all in a highly customizable format. With news Apple was implementing jewellery store-like security features, such as custom safes, not to mention hiring former Burberry chief executive officer (CEO) Angela Ahrendts as its new senior vice-president of Apple Retail, it is clear the tech company is entering new territory with its line of 18-karat gold watches. That said, I’m not sure a gold Apple Watch will overwhelm a very established fine watch industry. Allowing for some overlap, there are different market segments at play here, and only time will tell whether consumers will grow tired of recharging a timepiece every day or find they cannot imagine what life was like pre-Apple Watch.

[5]

[5]All manner of headphone and sound transmission devices, including one company promoting bone-conduction headphones worn forward of the ears, were abundant at CES. On the face of it, these devices do not seem to be directly related to the jewellery industry, but perhaps they are. Most of these objects are manufactured for functionality and not form. As such, there exists opportunity for a clever designer to create what might emerge as a new category within the jewellery realm. Think iPhone case here. If, for example, a particular headphone brand or style becomes dominant, it would be possible to quite rapidly prototype and manufacture customized coverings for this item as a personal accessory.”¨ Why couldn’t they be made of a more traditional jewellery material, such as a silver or gold alloy? With additive manufacturing, it is entirely possible to quickly bring these new concepts to market.

[6]

[6]One of the most interesting jewellery-related devices on display was a bracelet manufactured by Looksee. Marketed as an “advanced wearable,” the cuff features an always-on, e-ink display (like a Kindle or other reading device) that connects to a smartphone or other Bluetooth-capable device. Housed between leather, sterling silver, or stainless steel, the display uses proprietary software to create an ever-changing display of random patterns. It can also be programmed to show the time, as well as text messages received on a smartphone. A demonstration at the booth saw a photo taken of a unique pattern that was then programmed into the bracelet, demonstrating a uniquely customizable aspect of this bracelet. One of only five finalists in the techcrunch.com[7] ‘Hardware Battlefield 2015, the product is on its way to funding and will no doubt be commercially available very soon.

Judging from the array of wearables at CES, it is clear tech companies are becoming jewellers/watchmakers in a sense, and have had to learn about marrying function and fashion. Jewellers/watchmakers are now faced with the same challenge, as they try to manoeuvre the intricacies of incorporating technology into their designs if they want to get into the wearables sector. One could make a strong point that consumer electronics have captured a huge segment of market share in overall sales, especially during some of the all-important ‘gifting’ seasons. Jewellers and watchmakers can recapture at least some of that segment with the flair only our industry can provide if they choose to integrate technology with design.

Staying in the know

It is highly unlikely the pace of technical innovation will slow perceptibly in the next decade and it will be up to the individual jeweller as to how they adapt to—by adopting or avoiding—this trend. As an observer, I found wading through the hype and fanfare of CES quite rewarding. Rapidly changing technology demands that we carefully observe trends and keep our minds and options open for arising opportunities. New technologies hit the show floor in events like CES in quick succession, and a resourceful manufacturer or retailer within the jewellery industry can maintain and/or build market position by staying informed.

[8]Gary Dawson is owner of Gary Dawson Designs, an online custom design operation that was once featured as a “Best of the Best” by Instore magazine, as well as Dawson Distributions LLC, a supplier of CAD/CAM solutions for jewellers. Dawson has nearly 40 years’ experience in creating designs that capture the personalities and stories of his customers, and he is a frequent contributor to MJSA Journal. He has also delivered seminars and presentations at numerous events, including AGTA GemFair, Portland Jewelry Symposium, and the Santa Fe Symposium on Jewelry Manufacturing Technology. Dawson can be reached via e-mail at gary@garydawsondesigns.com[9].

[8]Gary Dawson is owner of Gary Dawson Designs, an online custom design operation that was once featured as a “Best of the Best” by Instore magazine, as well as Dawson Distributions LLC, a supplier of CAD/CAM solutions for jewellers. Dawson has nearly 40 years’ experience in creating designs that capture the personalities and stories of his customers, and he is a frequent contributor to MJSA Journal. He has also delivered seminars and presentations at numerous events, including AGTA GemFair, Portland Jewelry Symposium, and the Santa Fe Symposium on Jewelry Manufacturing Technology. Dawson can be reached via e-mail at gary@garydawsondesigns.com[9].

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/11/DSC_8327.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/11/Laser-Welder-Evo.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/11/dws028j.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/11/GV-Design-Aureus-with-white-background.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/11/AplWatch-Hero-Tumble-PRINT.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/11/DSC_9452.jpg

- techcrunch.com: http://techcrunch.com

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2015/11/Dawson.Gary-2-26-15204351.jpg

- gary@garydawsondesigns.com: mailto:gary@garydawsondesigns.com

Source URL: https://www.jewellerybusiness.com/features/new-technology-brings-new-opportunities/