Showtime on the strip: News, views, and trends from JCK Las Vegas 2018

by carly_midgley | July 31, 2018 10:58 am

By Carly Midgley

[1]

[1]Las Vegas: land of glitter, glamour, lights, and luck. What better place could there be to host one of the biggest jewellery events of the year? In its 2018 edition, from June 1 to 4, JCK Las Vegas returned to Mandalay Bay Resort & Casino one final time, creating a show floor that glowed with the hottest styles and buzzed with the latest industry news.

This year, the eyes of many attendees were on synthetic diamonds—both inside and outside of the show’s new lab-grown pavilion. De Beers Group’s announcement it will begin selling a fashion jewellery line featuring synthetic diamonds at prices as low as US$800 per carat left many vendors and visitors wondering about the future of the market.

“Based on some of the JCK show prices of lab-grown diamonds—as low as 70 to 80 per cent off Rapaport prices—De Beers’ Lightbox launch has already caused lab-grown diamond prices to drop,” says Renée Newman[2], author of The Diamond Handbook.

This isn’t the only wave of change bound for the jewellery industry, either. At JCK 2018, increasing demand for social and environmental responsibility was not far from attendees’ minds.

“Consumers, especially younger ones, are becoming more aware of sustainability issues concerning jewellery,” says writer and JB contributor[3] Cynthia Unninayar. “Brands are taking note and are using an eco-friendly approach in their marketing.”

The importance of these values to the modern buyer has not been lost on suppliers. At the Canadamark cocktail reception, held at the Four Seasons Hotel on June 3, Dominion Diamond executives made it clear next-generation consumers and the sustainable solutions they favour will be priorities going forward. The company is dovetailing a new, millennial-focused marketing strategy with initiatives such as a partnership with the government of the Northwest Territories to demonstrate its support for responsible production.

“In the Northwest Territories, our people are our number-one priority and most important resource, but it is the land that has given us what we need to sustain life,” said Bob McLeod, the territories’ premier, at the event. “Our diamond producers have the same vision as we do and have embraced the northern way of life. Together, we are promoting sustainable development, ensuring diamond mining is done with a consultative approach and that benefits will be had for generations to come.”

Back at JCK, the question of how to market to a brand-new demographic was pervasive on the show floor as well. Many brands are hitching their hopes on an omnichannel approach, combining traditional and technological methods of advertising. For bridal jewellery manufacturer Sylvie Collection, for instance, this means embracing the digital world with the release of its first professional video and the launch of a blog that shares customers’ engagement stories.

“The video has made a big difference,” says Cassie Pekar, the brand’s director of marketing. “There’s been great return on investment (ROI), especially on Facebook.”

Hand-in-hand with this emphasis on the digital is an equally strong push for personal connection. Numerous exhibitors noted the ability to forge a bond with the customer as an integral part of their success.

“One trend we noticed is the desire by both retailer and consumer for a strong and focused after-sales experience,” says Darren Dubrovsky, president of Empress Jewellery. “Give them a way to always remember what they created, and give them a keepsake of the process they embarked on with you.”

From a design standpoint, Malo Creations CEO, Habib Malo, says the key to capturing customers’ interest lies in understanding what they want. His strategy is to use customer feedback to create designs that respond to demand. This approach led the company to victory in the platinum jewellery under US$10,000 category at the 2018 JCK Jewelers’ Choice Awards.

“Precision, craftsmanship, technology, and innovation are all essential,” Malo says. “We strive to make pieces that are not just unique, but also sellable.”

Yet, what exactly makes a piece “sellable?” When it comes to the bridal market, shape and setting play a crucial role, according to Christopher Designs’ chief marketing officer, Michael O’Connor.

“Halos are still number one, as has been borne out in research we’ve seen from bridal publications and in our own conversations with retailers,” he says. “Ovals are an important shape that seems to go, maybe because of recent celebrity ring designs.”

RDI Diamonds owner Nico Palmieri also noted the growing popularity of two-carat ovals, and of large diamonds and “riskier” fancy shapes in general. Of course, shape and size are not the only important considerations—O’Connor says yellow and pink diamonds are in high demand, as are rose and yellow gold.

Indeed, rose gold was highlighted as the metal of the moment by many of JCK’s exhibitors. Christina Eliopulos, vice-president of sales for Bulova, says the metal’s popularity in the bridal market indicates customers have faith in its long-term appeal.

“Rose gold complements every skin tone, while yellow gold can be harsh,” she adds.

As for the watch market Bulova itself deals in, Eliopulos says recent trends have pointed to clean, simple, minimalistic designs, with a strong lean toward automatic movements.

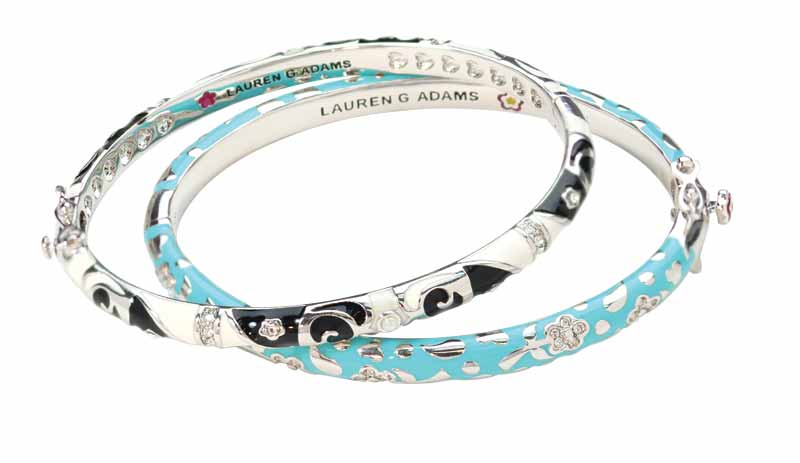

Stackables have also captured large swathes of the market, with stackable rings of all styles and price points on offer throughout the JCK show floor.

“It’s about really giving the customer endless possibilities to personalize a completely unique look,” says Blaire Hovis, director of fine jewellery for Stuller. “It’s all about mixing, matching, and stacking, whether to create the perfect fashion statement or add to that celebratory piece for an updated look.”

“A couple trends I observed included hoop earrings, mix-and-match stackable or customizable necklaces, rings, and bracelets, and the use of opals, emeralds, and aquamarine gemstones in designs,” adds Jen Cullen Williams, managing director of Luxury Brand Group. “There were certainly more trends, but those caught my attention as I walked the show floor.”

More than any particular cut, material, or style, however, one of the most talked-about trends of the show focused on quite a different consideration: price.

“We noticed most of the retailers that came by our booth and expressed interest in our brand said they sell fine jewellery, but were looking for something a bit different—something unique that had meaning behind it, but was also accessible and affordable,” says Naomi Traimer of Ontario-based MeditationRings.

Phillip Gavriel Maroof, president of Royal Chain Group, agrees.

“Recently, with rising prices, customers have moved more toward affordable, nonprecious metals,” he says. “My philosophy is getting fine jewellery back in the hands of the masses.”

To do this, Maroof is focusing on crafting designs that offer gold and silver at an accessible price point.

Indeed, Sean Polan of Italian jewellery brand Pesavento says, customers have made it very clear price plays an important role in their purchase decisions. To him, this means it’s necessary to offer a range of options.

“Instead of lots of $2000, $3000, or $4000 items, we have a lot more demographics to cover,” he says. “Our growth all happened when we made things more delicate and pricing hit a sweet spot.”

However, this doesn’t mean bigger, bolder styles are down for the count. Freydi Neuwirth Traurig of Gravure Commitment/Atlantic Engraving says buyers at this year’s high-end Luxury show were making braver fashion choices than in previous editions.

“I noticed the buyers to be bolder in their selections, going more out of the box than usual and being open to more fashion-forward and bolder styles—something we excel at,” she says.

Underlying these ever-pertinent questions of style, sales, and marketing, however, was the bigger question of the state of JCK itself. After a significantly downsized Baselworld in March left the industry feeling less than optimistic, many are beginning to question the relevance—and future—of trade shows.

“Compared to 20 years ago, trade shows seem to be losing some of their attractiveness,” says Unninayar. “They are expensive for exhibitors, and some I routinely saw in past years have opted out in order to concentrate on other methods of selling.”

Although final numbers were not available at press time, the show floor consensus seemed to be attendance was lower than usual. Like Unninayar, a number of exhibitors pointed to the high cost associated with JCK as a likely culprit.

“The show has become more expensive,” says Rodney Roberts, director of global sales for ARMS USA. “So far, it’s still worth it to attend, but some of the refinements have gone; it feels a little like corners have been cut.”

“Many people discussed with us their disappointment that large companies seemed to be dropping out at an alarming rate,” says Kyle Thomson, North American sales manager for Tense Watch. “I did hear a lot of vendors mention they would not be attending next year and that the cost did not justify the end results. Many seem to believe not enough is being done to really attract or interest the retailer.”

Reports of slow at-booth business surfaced as well, with some attributing this to marketing strategies and product offerings.

“There’s still been a good turnout,” says Pesavento’s Polan. “Business depends on the product you’re selling. Retailers come here to see what’s new.”

“Retailers are very busy and not too many, in my experience, will spend the time looking for new items unless they are made aware of them ahead of time,” adds Unninayar. “I noticed the exhibitors who had little marketing to or communication with retailers had few people visit their booths.”

So, are the glory days of JCK Las Vegas over? For many attendees, the answer to that question is still a resounding no.

“We hit the nail on the head by showing new styles. Our line thrives on repeat orders, but when our retailers see so many new items, it gets them reinvigorated,” says JB columnist[28] Todd Wasylyshyn of Keith Jack Jewellery. “They responded by pledging more counter space to accommodate the new elements in our line.”

“This was our best show yet,” adds Traimer. “We had a great response, as we were a finalist in the JCK Jewelers’ Choice Awards with our Eden MeditationRing, which attracted a ton of buyers to our booth.”

For companies like United Precious Metal Refining, in fact, JCK has a key role to play in improving relationships with customers.

“We look at the show as a form of advertising,” says Dave Siminski, United’s vice-president of sales and marketing. “There’s so much focus on digital advertising these days, but I think e-mail is the wrong medium. Poor communication is an industry problem, and relying on texts and e-mails draws that out.”

“As I walked the show’s various neighbourhoods, I felt a sense of optimism, as well as anticipation for the move to Sands Expo and Convention Center in 2019,” adds Cullen Williams.

Indeed, curiosity abounds about next year’s planned venue change, which places JCK at the Sands for the first time since 2010.

“I expect attendance to be higher, as people will be interested to see what’s new and how it will change,” says Neuwirth Traurig. “Everyone will be curious to try out the new venue for the first time again.”

“Having JCK/Luxury at the Sands will simplify the trip for retailers, who can merely walk across the street instead of having to trek across town to visit either JCK or Couture,” adds Unninayar. “This will likely result in more buyers attending both shows.”

Sam Mamane, president of Italgem Steel, echoes this sentiment, highlighting some of the logistical difficulties inherent in the show’s current venue.

“This year’s show map was not well organized,” he says. “I think the Sands will have a better layout, and we will continue to exhibit at JCK.”

However, as Tense Watch’s Thomson points out, location alone does not make the show.

“The venue change could be a plus, I think, but much more will be needed in order to save the show or at least keep it relevant,” he warns. “At this point, we would likely need to see a decrease in expenses going forward.”

Just how JCK might adapt to these problems remains to be seen, but in the meantime, Wasylyshyn says attendees should bear in mind the fact their ultimate success depends on something else altogether: themselves.

“There’s no magic,” he says. “The show will not solve any of your problems. Take good care of your accounts, bring value to their businesses, ask for referrals, keep things fresh with new products, prepare yourself with advance promotion and appointments, and then the show will bring you ‘good luck.’”

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/DSC_6355.jpg

- Renée Newman: https://www.jewellerybusiness.com/features/detecting-pearl-imitations-and-treatments/

- JB contributor: https://www.jewellerybusiness.com/features/mining-in-myanmar-the-road-to-mandalay-and-mogok/

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/MG_8307.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/Lafonn_E0279CSP.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/CA0442E-1.00_1000x1000_PERS.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/WDNAG215.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/RC3638_2.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/SILR6926-08.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/2Ring_Coronet-By-Reena-Ahluwalia_Silver_Swarovski_Soul-Carousel-Collection.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/AB450-B2-TPL01.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/chris.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/MRDA-067_B-PLAT.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/Belle-Étoile_Laguna-Blue-Purple-and-Teal-Earrings_MSRP-225_RGB.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/ANONIMO-EPURATO-blu-intenso-G03201_P.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/Stackables.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/98A213_FEATURE_02_cmyk.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/tense.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/14K-Rose-Stackable-Crown-Ring.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/s1603-web.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/PPX6242.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/Eden-MR2257-JCA.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/max-bill-Chronoscope-027_4502_00_CMYK.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/Pride-Hero-Shot.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/FL8-1600-Rose-Edges.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/CL43.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/AI6008_SS002_430_1.jpg

- JB columnist: https://www.jewellerybusiness.com/features/death-of-a-sales-rep/

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/Special_canada.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/TIARA_HO_Crop.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/rose_girafe70261600100000.jpg

- [Image]: https://www.jewellerybusiness.com/wp-content/uploads/2018/07/7733D-W-W.jpg

Source URL: https://www.jewellerybusiness.com/features/showtime-on-the-strip-news-views-and-trends-from-jck-las-vegas-2018/

[4]

[4] [5]

[5] [6]

[6] [7]

[7]

[8]

[8] [9]

[9] [10]

[10] [11]

[11]

[12]

[12] [13]

[13] [14]

[14] [15]

[15]

[16]

[16] [17]

[17] [18]

[18] [19]

[19]

[20]

[20] [21]

[21] [22]

[22] [23]

[23]

[24]

[24] [25]

[25] [26]

[26] [27]

[27]

[29]

[29] [30]

[30] [31]

[31] [32]

[32]