Terrorist financing, money laundering, and the Canadian jewellery industry

The threshold that compels compliance

The threshold at which a DPMS becomes a reporting entity and subject to the requirements of this legislation is described in Section (39)1 of the regulations.

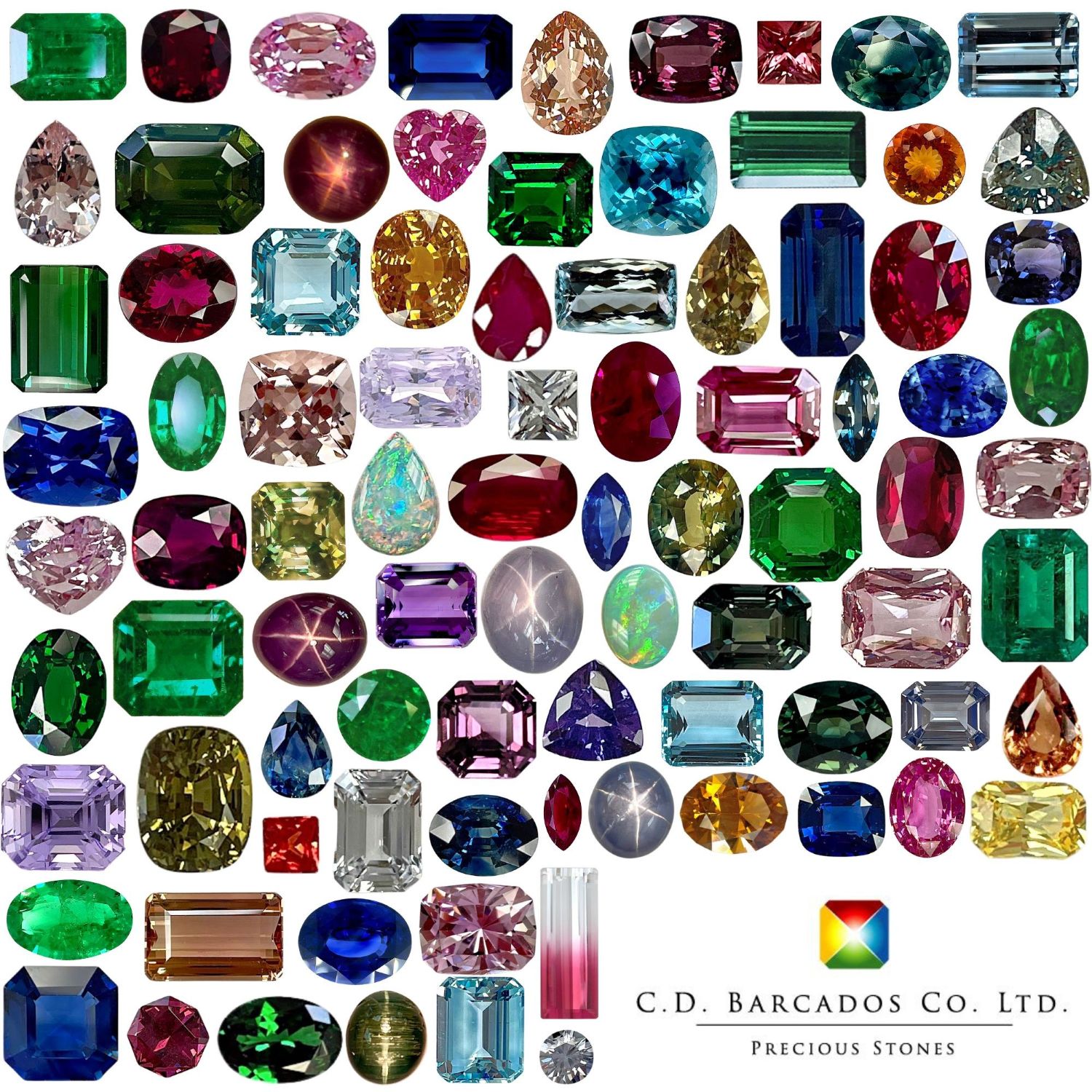

Every dealer in precious metals and stones that engages in the purchase or sale of precious metals, precious stones, or jewellery in an amount of $10,000 or more in a single transaction, other than such a purchase that is carried out in the course of, in connection with, or for the purpose of manufacturing jewellery, extracting precious metals or precious stones from a mine, or cutting and polishing precious stones, is subject to Part 1 of the Act.

As you can see, the threshold at which a DPMS becomes a reporting entity is quite low. If you or your company has ever made a purchase of precious metals, stones, or jewellery in the amount of $10,000 or more in a single transaction, including a purchase of inventory, you are recognized to be a DPMS reporting entity and fall under the obligations of the act and regulations. This event marks the line that, once crossed, obliges you to have an AML compliance regime in place. Neither the method (i.e. cash or wire transfer) nor the terms of payment (i.e. in advance, upon delivery, or installments) have any bearing. Once a DPMS has engaged in that threshold purchase or sale, they are considered by law to be a reporting entity—there is no turning back. In addition, a DPMS reporting entity is required to be in compliance moving forward for as long as the business exists.

Don’t confuse the $10,000 reference in the threshold event with the large cash transaction reporting requirements. They happen to be the same monetary figure, but they are quite separate events with different implications. The threshold event makes a DPMS a reporting entity and subject to the legislation. Every cash transaction in which a DPMS reporting entity is involved with in the amount of $10,000 or more (to the same beneficial owner in a 24-hour period) is a very separate event and triggers the large cash transaction reporting requirement.