Terrorist financing, money laundering, and the Canadian jewellery industry

by charlene_voisin | December 1, 2014 9:00 am

By Ken Brander

[1]

[1]

If, after reading the title of this article, your chest tightened a bit, your pulse rate spiked, and you had a hard time swallowing, rest assured, these are not uncommon responses. There’s no need to speed dial your physician quite yet. However, you should keep reading, since just like a lingering health concern, your anti-money laundering compliance program requires your ongoing attention, lest it flare up and cause you some serious grief.

Money laundering, terrorist financing, compliance regimes, administrative monetary penalties, and criminal charges may seem out of place in the jewellery industry. However, since 2008, Canada’s dealers in precious metals and stones (DPMSs) have been deemed one of the 10 reporting entities of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its regulations. As such, you have a number of legal obligations with which you must comply. These requirements are not optional and you ought to consider them as another cost of doing business, similar to insurance and advertising.

As a former officer with the Edmonton Police Service, I spent 25 years investigating fraud, corruption, and money laundering in Canada and internationally.”¨ In this article, I am going to help you understand how and why this law came about and the implications for you and your business. I’ll also share my thoughts on what you can expect from regulators, as well as some common misconceptions jewellers have that could lead them into serious trouble.

How’d we get to this point?

[2]

[2]Canada’s anti-money laundering (AML) legislation is by no means unique in the world. In fact, you might be interested to know most countries have very similar laws in place. This is not just a coincidence. Canada is part of the global anti-money laundering and terrorist-financing (TF) regime that took hold in 1989 with the advent of the Financial Action Task Force (FATF), an inter-governmental body formed by the Group of Seven (G7) countries. Canada is a member state of both the G7 and FATF, and has a great deal of national pride and actual resources invested in these organizations. Each has become a permanent fixture in geo-economic politics, which means AML/TF compliance is not a transient affair. It’s here to stay and if anything, enforcement, regulations, and monetary fines are on the rise in Canada and internationally.

The G7 leaders created FATF in response to the gross amounts of money laundering transactions chartered banks were conducting on behalf of organized crime during the 1970s and 1980s, most notably Colombia’s drug cartels. After the 9/11 attacks, FATF also became involved in recommending actions to identify terrorist financing. As a G7 and FATF member, Canada has, therefore, long been involved in the effort to keep proceeds of crime and terrorist financing out of the world’s legitimate financial system.

FATF is the global authority on anti-money laundering and terrorist financing regulatory framework. As such, it makes recommendations, sets policies and procedures, and assesses AML regimes of member states. Currently, there are 34 FATF member states, eight regional FATF-style organizations (e.g. Eastern and Southern Africa Anti-Money Laundering Group [ESAAMLG]), and 25 FATF observers, including the United Nations, World Bank, and Interpol. FATF has made 40 recommendations that member states are expected to adopt fully into domestic legislation. They address the following:

- ҬAnti-money laundering and terrorist-financing policy and co-ordination;

- Laws relating to money laundering and confiscation of proceeds of crime;

- Financial activities related to the funding and proliferation of terrorism;

- Preventative measures, including customer due diligence, record keeping, etc.;

- Transparency and beneficial ownership;

- Powers and responsibilities of competent authorities, including financial intelligence units (FIUs); and

- International co-operation.

To be compliant with FATF’s recommendations, Canada has enacted federal legislation that directly affects you as a dealer in precious metals and stones (DPMS). Specifically:

- ҬIn 2000, Canada passed the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. There have been a number of amendments over the years.

- The act establishes the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as the country’s financial intelligence unit.

- The act establishes 10 types of business sectors in Canada required to be in compliance. These businesses are termed ‘reporting entities’ (RE).

- Among other things, FINTRAC conducts examinations on Canada’s reporting entities to evaluate and ensure compliance with the act and regulations.

- FINTRAC has authority to assess administrative monetary fines and recommend criminal charges against individuals and reporting entities found to be in non-compliance with the act and regulations.

- ҬFINTRAC receives reports from reporting entities, analyzes those reports, and creates intelligence packages that assist domestic and international law enforcement agencies investigate money laundering and terrorist financing.

- DPMSs became reporting entities and subject to the act and regulations in 2008.

A DPMS defined

As a reporting entity, every DPMS, regardless of how large or small, must comply with the act and regulations. With the exception of a few elements, a DPMS reporting entity must have essentially the same compliance regime as Canada’s other reporting entities, such as financial institutions, securities dealers, and casinos.

Definitions are very important in law. The act and regulations are interpreted and applied according to the strict meanings of key words and phrases. FINTRAC applies these definitions using these specific meanings. For instance, in the context of the act and regulations, there are six types of precious stones, no more and no less. In terms of your compliance regime, you must adopt this definition, too. It is crucial for you as a DPMS reporting entity to recognize the business activities, products, and services you offer that draw you into this legal regime. The first step is to understand the legislation’s key terms. The following definitions are found in Section 1 of the act.

- ҬPrecious metal means (only) gold, silver, palladium, or platinum in the form of coins, bars, ingots or granules, or in any other similar form.

- Precious stones means (only) diamonds, sapphires, emeralds, tanzanite, rubies, or alexandrite.

- Jewellery means objects made of gold, silver, palladium, platinum, pearls, or precious stones intended to be worn as a personal adornment.

Section 1 of the regulations defines a DPMS to mean: “a person or an entity that buys or sells precious metals, precious stones, or jewellery in the course of business activities.” There are three elements to the definition: - A person or entity;

- That buys or sells; and

- Precious metals, precious stones, or jewellery in the course of business activities.

The definition of DPMS, by design, is very broad and applies to the business activities of people and entities, not their particular role or function in the jewellery industry. There is not one set of rules for retailers and another for wholesalers, for instance. Refiners and cash-for-gold operations are likewise not distinct. If you meet these three criteria, then you as a ‘person’ or your company as an ‘entity’ are in fact a DPMS reporting entity.

For sales agents and sales agencies selling products on behalf of a supplier, your standing as a DPMS is entirely dependent on your particular business practices and the arrangements you have with the company you represent. A key consideration is whether you physically conduct the transaction. If you provide the product on behalf of the supplier and receive payment from a customer, you are deemed a DPMS. Even in circumstances where the AML compliance responsibilities might fall on the company whose products you are selling, some reporting requirements, such as client identification, suspicious transaction reports, and large cash transaction reports, might fall on you. If you are conducting transactions on behalf of some other entity, you need to co-ordinate your AML obligations and above all, have this arrangement documented in writing. If in doubt, seek clarification.

The threshold that compels compliance

[3]

[3]The threshold at which a DPMS becomes a reporting entity and subject to the requirements of this legislation is described in Section (39)1 of the regulations.

Every dealer in precious metals and stones that engages in the purchase or sale of precious metals, precious stones, or jewellery in an amount of $10,000 or more in a single transaction, other than such a purchase that is carried out in the course of, in connection with, or for the purpose of manufacturing jewellery, extracting precious metals or precious stones from a mine, or cutting and polishing precious stones, is subject to Part 1 of the Act.

As you can see, the threshold at which a DPMS becomes a reporting entity is quite low. If you or your company has ever made a purchase of precious metals, stones, or jewellery in the amount of $10,000 or more in a single transaction, including a purchase of inventory, you are recognized to be a DPMS reporting entity and fall under the obligations of the act and regulations. This event marks the line that, once crossed, obliges you to have an AML compliance regime in place. Neither the method (i.e. cash or wire transfer) nor the terms of payment (i.e. in advance, upon delivery, or installments) have any bearing. Once a DPMS has engaged in that threshold purchase or sale, they are considered by law to be a reporting entity—there is no turning back. In addition, a DPMS reporting entity is required to be in compliance moving forward for as long as the business exists.

Don’t confuse the $10,000 reference in the threshold event with the large cash transaction reporting requirements. They happen to be the same monetary figure, but they are quite separate events with different implications. The threshold event makes a DPMS a reporting entity and subject to the legislation. Every cash transaction in which a DPMS reporting entity is involved with in the amount of $10,000 or more (to the same beneficial owner in a 24-hour period) is a very separate event and triggers the large cash transaction reporting requirement.

Narrowly defined exceptions

[4]

[4]FINTRAC Guideline 6(l) “Record Keeping and Client Identifications for Dealers in Precious Metals and Stones” provides additional interpretation of the exceptions identified in Section 39(1). You will note the exception is extremely focused and few companies will actually meet the requirements to be exempt from the act and regulations.

If you conduct manufacturing, mining, cutting or polishing and all or substantially all of your purchases and sales are related to these activities, you are not subject to these obligations unless you conduct a transaction of $10,000 or more with a consumer.

In this context “all or substantially all” means 90% or more of your purchases or sales are related to manufacturing, mining, cutting or polishing activities.

The term ‘consumer’ is not defined in the act or regulations and should be interpreted broadly. Consider anybody who purchases your goods to be a ‘consumer.’ As one FINTRAC investigator put it to me, unless all you do is repair watches, you will fall under the jurisdiction of this legislation. The consequences for non-compliance can be severe, even in the form of criminal charges, affecting your bottom line and reputation, since the names of companies found not to be in compliance are published on FINTRAC’s website. In this regard, compliance ought to be seen as a standard business practice, much like bookkeeping, advertising, and paying taxes.

What is expected of a reporting entity to be compliant?

The act and regulations are very specific about what activities a DPMS reporting entity is required to complete and how, the records that need to be kept and how, and how compliance is to be documented. To be compliant, all DPMS reporting entities are required to do the following:

- Register their business as a DPMS reporting entity with FINTRAC.

- “¨Have in place a five-part compliance regime that includes the following elements:  Â

• The appointment of a compliance officer;Â

• The assessment and documentation of the risks of money laundering and terrorist financing to the DPMS and measures to mitigate that risk (i.e. risk-based assessment);

• The development and application of written compliance policies and procedures;

• The implementation and documentation of an ongoing training program; and

• A documented review of the effectiveness of the risk assessment, policies and procedures, and ongoing training program. This review is to be conducted every two years. - Submit three types of reports to FINTRAC:

• Suspicious transaction reports;

• Large cash reports; and

• Terrorist property reports. - Recognize when the DPMS has entered into a business relationship. In this context, business relationship should be interpreted as a ‘high-risk relationship’ and obliges the DPMS to conduct enhanced due diligence and record keeping. For more, see the article on page 70.

- Make a determination whether a third party is involved in the transaction and respond pursuant to the act and regulations.

- Keep four types of records on file for a period of at least five years:

• Records of suspicious transactions;

• Records of large cash transactions;

• Records of business relationships (i.e. high-risk customers); and

• Records of third parties involved in transactions. - Ascertain identity.

- Obtain and use personal information lawfully.

As you can see, there is a great deal that you, as a DPMS reporting entity, must do to be compliant.

What to expect from FINTRAC

[5]

[5]Among other functions, FATF conducts mutual evaluation reports (MERs) of member states to determine the degree to which they have incorporated the 40 recommendations into domestic law, as well as their compliance. Canada has had two evaluations, the first of which was in 2008. At the time, Canada was found to be non-compliant in a number of areas, specifically regarding beneficial ownership, ongoing due diligence, and enhanced measures for high-risk customers. Having addressed the issues from the first MER, Canada was determined to be fully compliant with FATF’s recommendations during the follow-up evaluation that took place this year. All this goes to demonstrate that Canada considers FATF compliance to be very important. When FATF talks, Canada listens.

As a DPMS reporting entity, you should be very concerned about another FATF report released earlier this year entitled, “Money Laundering and Terrorist Financing Through Trade in Diamonds.” This document was very comprehensive and examined money laundering typologies at all stages of the diamond pipeline.

It revealed that Canada assesses the level of its own DPMS reporting entities’ AML/TF compliance as a lackluster ‘medium.’ Globally speaking, FATF found that international FIUs are not receiving many reports from Canada’s diamond dealers. The authors noted, “This may be an indication there is not enough awareness in the sector of the importance of combating ML and TF within the diamond sector and that diamond dealers are not sufficiently aware their sector is being misused by criminal organizations to launder their proceeds.”

This FATF assessment is supported by FINTRAC’s own estimation. Earlier this year, I submitted a request under the Access to Information Act and gained valuable insight into how FINTRAC grades DPMS compliance. In a word: dismal. The internal correspondence I received as part of my request judged DPMS compliance in the areas of policy and procedure, risk assessment, ongoing compliance training, and the two-year review. Consider these appraisals from a FINTRAC insider:

- “The majority of the reviews conducted by the reporting entity were complete deficiencies, since no documentation was provided to support a review of the compliance regime.”

- “A minority of the [reporting entities] develop just-in-time policy and procedures, however, in those cases where they are developed, the policies and procedures do not address some or all of their obligations under the PCMLTFA.”

- “¨”The smaller entities primarily are not aware of the requirement to conduct training due to the size of their organization.” These types of comments go on for two pages.

As we observed earlier with Canada’s response to FATF’s evaluation, what this group says matters and Canada will legislate change across all business sectors to get its national AML/TF regime up to international standards. FATF’s typology report on money laundering through diamond trade also matters and you can rest assured FINTRAC has read it and will formulate a strategic response. FINTRAC itself recognizes sector-wide systemic deficiencies across virtually every DPMS AML/TF obligation. The Canadian jewellery industry is facing a failing grade in this regard and should, therefore, expect increasing regulatory attention from FINTRAC.

Common misconceptionsӬ that could hurt you

[6]

[6]Recently, I attended a Canadian jewellery show and spoke with a number of jewellers about their AML compliance programs. The folks I met generally grouped themselves into two separate camps. Most had no idea what I was talking about and were shocked to learn of the act, the regulations, FINTRAC, and their legal obligations. Many in this group were relatively new business owners. The second group of people was at least generally aware of their obligations, but really felt no impetus to comply. Many thought that since they had been in business with no visits from FINTRAC for so many years, there was no real reason to worry, that this was just another cash cow for the federal government, or that they’d simply brush FINTRAC off if they ever actually called.

I hope by this point in the article, you have come to realize your AML/TF obligations are nothing to take lightly. You have tremendous investment in your business and shouldn’t dismiss the act, the regulations, or FINTRAC. This regime is a global movement and Canada is firmly committed. Simply review the administrative fines FINTRAC has assessed to other small business owners just like you to recognize the seriousness of this requirement. The average fine per violation is more than $3000 and FINTRAC usually assesses a reporting entity with multiple fines. Plus, names are posted on FINTRAC’s website. Being publically cited and fined for breaching federal money laundering and terrorist-financing laws is bad for business. On top of those fines, you’ll still need to get your AML/TF program in place. If you think the cost of compliance is high, consider the cost of non-compliance.

I spent a lot of time speaking with members of Canada’s jewellery industry this summer. Here are some of the more dangerous misconceptions I heard that could really hurt you.

I don’t plan on registering my business with FINTRAC. If they don’t know about me, I should be able to stay unnoticed.

This is analogous to not paying your personal income taxes until Canada Revenue Agency (CRA) comes knocking on your door. Do you know anybody who has had a CRA audit? They’re not pleasant. You should assume FINTRAC knows about your business, as it shares information with other federal government agencies, including CRA. When data mining, it’s pretty easy to run a search through tax returns and identify businesses involved in jewellery sales. Plus, FINTRAC investigators read magazines like this one and surf the Internet looking at your advertisements. Don’t assume FINTRAC doesn’t know about you just because you haven’t registered your business.

I don’t accept cash sales, so I don’t have to report to FINTRAC.

This statement demonstrates a lack of understanding about the threshold event that makes a DPMS a reporting entity and subject to the act and regulations. Remember the trigger—which is subject to incredibly restrictive exceptions—is the purchase or sale of precious metals, precious stones, or jewellery in an amount of $10,000 or more in a single transaction. This includes an inventory purchase and it doesn’t matter how you paid for it.

If you never accept cash from a client, you will never have to submit a large cash transaction report to FINTRAC. However, don’t confuse the reporting requirement with the threshold event that activates your legal obligations. They are very different.

If and when FINTRAC calls, I’ll just throw something together quickly or drag things out.

I met a jeweller who was called up by FINTRAC for a compliance examination. A good deal of his business involved jewellery repair and he had never heard of the act or the regulations, and was completely caught off guard. It took him more than two weeks of work, all day and every day, to get enough of a compliance program assembled to please the investigator. That is time he could have spent repairing jewellery and earning sales. It was clearly stressful for him.

Some people are very comfortable managing risk through a crisis. Most of us, like my jeweller friend, are not, and we prefer to be more proactive managing our affairs. Keep in mind this important point: Canada’s DPMSs have been under this legislation since 2008. Don’t expect much in the way of concessions from the regulator.

I’m a wholesaler and I don’t deal with customers off the street. I’m exempt from this, since I sell to retailers, not the general public.

Not true. Remember the threshold event drawing you into this legislation involves a single purchase or sale over $10,000 in a single transaction, regardless of how payment was made and regardless of who you bought from or sold to. The threshold applies to all parties in the transaction, including wholesalers. Depending on your business activities as a reporting entity, you may never come across a situation where you have to submit a large cash transaction or suspicious cash transaction reports; however, you do need to have all the elements of a compliance regime in place to meet your obligations under the legislation.

How are you feeling?

[7]

[7]Complying with this legislation is demanding and technical. It’s also something you might not want to tackle on your own. Before you get too angry at the federal government, just take a moment to reflect on the true source of your angst. You have to comply with this legislation because criminals are searching for ways to convert and conceal the profits of their criminal activities. As regulators around the world force banking practices to tighten up, these crooks are going to look for alternatives to cash deposits and mortgages. Your business is one of the alternatives they’re looking at.

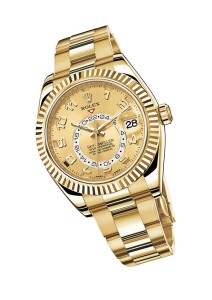

There are lots of good reasons not to conduct business with these types of folks, but we’ll save that for another article. However, you need to recognize some types of businesses and consumer products are more suited to launder money than others. Precious metals and stones, and in turn, the jewellery made from them, are particularly attractive products to launder money and assist terrorist groups with financing their operations. Diamonds are especially vulnerable to being used in this manner. As a DPMS reporting entity, you are therefore a target of money launderers and those attempting to finance terrorist groups. This sounds harsh, maybe even extreme. However, by virtue of the products and services you offer, it is in fact a reality for your business.

Canada’s objective is not to weigh you down with administrative anchors, milk a cash cow, or prevent you from doing business. Above all, the federal legislation and FINTRAC aim to create a reporting mechanism that captures details of certain transactions and the people involved in those transactions, analyze this intelligence, and then share parts of it with police. As a former police detective who has benefitted from FINTRAC intelligence products, I can attest the information provided by Canada’s reporting entities is an important tool to help successfully investigate and prosecute criminals and those financing terror inside Canada and beyond our borders. Reporting entities such as you are Canada’s front-line defence against money laundering and terrorist financing. You see the suspicious activity long before the police or FINTRAC ever do.

Your lawful obligations are many and creating a compliance regime is a major undertaking requiring expertise, continued attention, and investment. Being compliant is an achievement for you and your business, one you might even consider promoting in your business advertising. As a consumer, I can assure you that credentials and business practices matter and influence customer choice.

Finally, here is a bit of good news. This article can be used as proof of compliance toward your ongoing training obligations. Have your staff read the article, initial your training log, and keep the feature in your FINTRAC file.

The act, the regulations, FINTRAC, and the bad guys are here to stay. In the near future, you can expect increased regulatory attention, not less. This is not something you can avoid and it is simply beyond your control. For most ‘persons’ or ‘entities’ involved in the jewellery business, building an AML compliance regime is an exercise they’d prefer to do tactically under their own terms. After all, the strategic application of resources is usually always preferred over crisis management. So, breathe easy, visit FINTRAC’s website, shop around for some expertise, and start thinking about your AML compliance strategy moving forward.

For more read The word on watches[8] and Risky Business[9].

Ken Brander recently retired after a distinguished 25-year career with the Edmonton Police Service. He specialized in the investigation of fraud, corruption, and money laundering in Canada and internationally. In 2011, Brander spent nine months on the Afghan Threat Finance Cell investigating government corruption and money laundering. He has presented at international conferences and recently completed a contract for the UN Office on Drugs and Crime in Africa. Brander is president and principal consultant at Clarium Fraud and Compliance Solutions Ltd., a firm offering AML compliance products for Canadian DPMSs. He can be reached at www.clariumfcs.com[10].

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2014/12/bigstock-Money-On-Rope-236225.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2014/12/bigstock-Three-diamonds-62929522.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2014/12/bigstock-gold-necklace-with-gems-isolat-21902654.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2014/12/bigstock-successful-woman-portrait-je-40025077.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2014/12/bigstock-Stack-Of-Canadian-Dollar-53368621.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2014/12/09_Sky-Dweller_Yellow-gold.jpg

- [Image]: http://www.jewellerybusiness.com/wp-content/uploads/2014/12/bigstock-Tribute-In-Light-186659.jpg

- The word on watches: http://www.jewellerybusiness.com/?p=16726

- Risky Business: http://www.jewellerybusiness.com/?p=16733

- www.clariumfcs.com: http://www.clariumfcs.com

Source URL: https://www.jewellerybusiness.com/features/terrorist-financing-money-laundering-and-the-canadian-jewellery-industry/