Trade in and trade up

The uncertain economy has made pre-owned watches—both vintage and newer used pieces—more popular than ever with clients looking for a safe place to invest or the chance to own a luxury piece with a more affordable price tag. Despite the increasing demand, the number of retailers willing to buy and sell vintage and pre-owned timepieces remains small in Canada. Many are scared off by the high upfront costs, threat of fakes, cost of refurbishment, and need for detailed knowledge about the watch industry, past and present. But for those willing to invest the time and money in used high-end watches, the payoff can be huge.

A few years ago Frank Damiani, owner of Damiani Jewellers in Woodbridge, Ont., wouldn’t have even considered buying a client’s old watch. He felt the same way about the cash-for-gold business. Then a customer asked him to send her jewellery along with his unsold gold to the refinery. Slowly, he started to offer the service more and more, much to his customers’ appreciation. When a client asked if Damiani would take an old Rolex, he saw another opportunity and took a chance. Now he sells two to three second-hand watches a month. While Damiani says taking in and selling pre-owned watches represents a tiny portion of his business, he adds a vintage piece can offer 20 to 30 per cent margins that can bring in $1000 or more in profits.

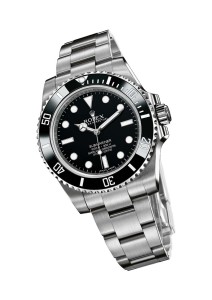

“I have a lot of my customers coming in with Rolexes,” Damiani explains, himself an authorized Rolex dealer. “These watches still have a lot of life in them.”

In fact, it’s not unusual for a client to come in with a watch they’d only just purchased a few months prior. Once on display, they rarely last more than a few weeks. “My customers love these watches because they can be had for half the retail price,” he adds. While Damiani says he has bought a few Cartier and Omega gold watches in the past, he tends to stick with Rolex. “It is where I have expertise and the parts to restore them.”

After checking the Rolex database to ensure a watch isn’t stolen, Damiani refurbishes it in-house to make it “like new again.” He often benefits from both ends of the deal, using his purchase of a watch as an incentive for a client to buy something else.

The impact of fashion on the watch industry means customers are often eager to change up their timepiece, a marked difference from decades ago. “In the old days, you bought a (wristwatch) for the rest of your life,” he says.

Sean Polan, a 30-year veteran of the watch industry and owner of distribution company, Sothil Inc., explains there are essentially two types of clients in the pre-owned watch market. On one end is the customer who wants the prestige of owning a luxury watch, but can’t afford to buy a new timepiece. For a few thousand dollars, they can own an impressive watch they can later sell and upgrade as they progress in life, he says. And in many cases, the watch is in perfect condition, adds Polan. “You’re almost buying it new.”

There is also the collector buyer, who is looking for a unique piece and is willing to pay a hefty premium to own it. Aron groups dealers in the same category, noting the Internet and availability of pricing have essentially melded the two. Collectors are often willing to pay in the tens of thousands for a watch, he explains.

Ironically, it is the poor sellers from decades ago that are the most sought-after today, since they were sold in smaller numbers. Popular watches made with high-end metals don’t fetch nearly as much as some stainless steel models that were considered failures when first introduced in the 1960s and ’70s. Limited editions are also in demand, being traded almost like rare baseball cards. Aron says he is willing to buy both older and newer pre-owned watches, although he tries to sell those ones immediately, keeping the vintage models for collector customers.